Pakistan and China finalized talks for the second phase of their Free Trade Agreement in Beijing last month. They are expected to sign a revised mutually agreed upon protocol agreement this month.

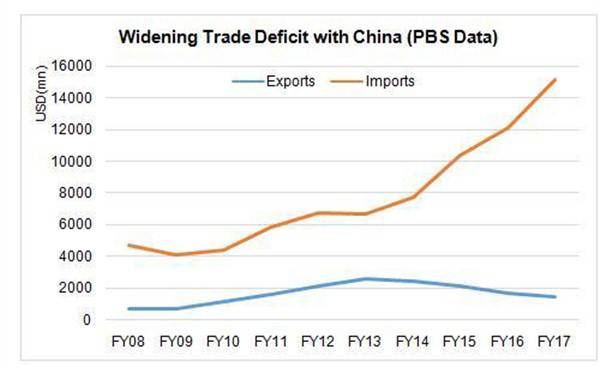

This China Pakistan Free Trade Agreement is important as the success of the much-vaunted China-Pakistan Economic Corridor hinges on its second phase. Islamabad cannot manage its yawning trade and current account deficits. Last year, Pakistan’s trade deficit was $32 billion and with alone China its figure had crossed the $12 billion mark, making it impossible for Islamabad to sustain such a huge deficit with any single country. If it is not rescued swiftly, it will have no choice but to go to the IMF. So now it’s a fight for survival.

Pakistani negotiators claim that they had persuaded the Chinese side to insert clauses to protect Islamabad’s interest, given the increasing trade deficit with China, as part of the revised free-trade agreement draft. Now Pakistan will be able to invoke safety clauses if it finds that specific items are hurting its trade interests.

Former State Bank of Pakistan governor Dr Ishrat Husain has argued that Islamabad would have to seek market access from China equivalent to that of the ASEAN region as their tariff was less than Pakistan’s. This means, in essence, that our exports are at a disadvantage and cannot compete with those of other countries. But how much can this special treatment fix the problem? Can Pakistan’s exports go up if it gets the same as ASEAN countries? Dr Husain said it was difficult to speculate or give any figure.

Some numbers have been put forward by renowned economist Dr Akmal Hussain. In a recent study, he estimated that Pakistan’s trade could get a share of $45 billion by getting a one percent share out of the total volume of $4,447 billion on a per annum basis.

Preferential trade agreements at the global level are aimed at achieving a quantum leap to promote trade. Pakistan has signed a total of seven Preferential Trade Agreements and Free Trade Agreements with different countries and regions. This includes the China-Pak FTA, the Malaysia-Pakistan Comprehensive Economic Partnership Agreement, South Asian Free Trade Agreement, Pakistan-Sri Lanka FTA, Pakistan-Indonesia PTA, Pakistan-Iran PTA and Pakistan-Mauritius PTA. It is currently negotiating free trade agreements with three more countries: Thailand, Turkey and Iran.

The preferential trade agreements promote trade through a gradual tariff reduction and provide better market access compared with other partners. There are many reasons, however, why Islamabad has failed to benefit from such agreements. Two major reasons are that it signs them without doing its homework and it is unable to generate exportable surpluses for a variety of reasons. One of them is the increasing cost of doing business in Pakistan.

Since 2000, a flurry of FTAs across the world were struck, especially in Asia. India signed 14, South Korea 16, China 17 and Vietnam 11. The Pak-China agreement in goods was signed on November 24, 2006 and was implemented from July 1, 2007. The agreement had two phases. Under the first phase, Pakistan reduced tariffs to zero duty on 2,423 tariff lines. (Tariff lines are products defined at a highly detailed level for the purpose of setting import duties.) China reduced the duty to zero on 2,681 tariff lines. The products in which China reduced its tariff by 50% included fish, dairy products, frozen orange juice, plastic products, rubber products, leather products, knitwear and woven garments.

After this agreement, bilateral trade went up from $4 billion in 2007-8 to $15 billion for 2016-17 with Pakistan’s exports at $1.4 billion and imports at $14 billion. Pakistan and China have held nine rounds of negotiations. For the second phase, China has proposed tariff elimination on 90% of the lines. Pakistan has requested that before embarking on this phase, it be granted unilateral market concessions on products of its primary interest in order to restore eroded market shares. China has FTAs with Chile, New Zealand, Singapore, Peru, Costa Rica and the ASEAN region.

When the ASEAN-China FTA went into effect in 2010, Pakistan registered a preference erosion on tariff lines that amounted to 79% of its export volume to China and the main tariff lines include cotton yarn, garments, leather and fish. Keeping China’s arrangement in view, these countries enjoyed incentivized tariffs and Pakistan lost out as with New Zealand 94% of the tariff lines are at zero duty, Malaysia has 94% of tariff lines at zero duty, Indonesia 93%, Thailand 93%, the Philippines 93%.

With Pakistan, only around 35% of the tariff lines are at zero duty under the FTA arrangement. So Pakistan is at a disadvantage. Pakistan could only export in 253 tariff lines, where average export value is $500 or more, which is around 3.3% of the total tariff lines (7,550). Pakistan mainly exported raw materials and intermediate products such as cotton yarn, woven fabric, grey fabric etc. The value-added products were missing from the incentive package.

Pakistan had proposed adjustments in the first phase during the initial meetings. The Chinese assured us that Pakistan’s concerns would be addressed in the second phase. It was agreed that negotiations would be held on a less than equal reciprocity principle in favour of Pakistan. The second phase requests and offer lists would be formulated independent of the first phase tariff liberalization.

For the second phase, Pakistan has proposed elimination of the tariff on 40% of lines, immediately to zero (including the MFN zero tariff) on the date of entry into force of the second phase. It proposed an elimination of tariff on 10 percent tariff lines to zero within five years from the date of entry into force. No reduction on tariff on 20 percent tariff lines was proposed.

Pakistan also proposed that before entering into the second phase, China grant an immediate concession on 35 to 40 tariff lines in Pakistan’s prime export interest. The Chinese proposed, however, that Pakistan may take longer and additional categories to achieve a 90% liberalization level. “If Pakistan is granted a concession equivalent to ASEAN’s in the top 20 products of its priority list, Pakistan’s exports to China would jump $257 million,” said one study done by the Ministry of Commerce. It is estimated that if Pakistan is granted complete liberalization by China, exports could go up by $542 million annually. Pakistan has also sought unilateral market concessions from China on cotton yarn, rice, nuts, plastic waste, leather, trousers, frozen fish and crabs before embarking on the second phase.

A senior official at the Ministry of Commerce said that the draft of the revised agreement was being readied but details could not be shared with the media. He said to wait a month.

This China Pakistan Free Trade Agreement is important as the success of the much-vaunted China-Pakistan Economic Corridor hinges on its second phase. Islamabad cannot manage its yawning trade and current account deficits. Last year, Pakistan’s trade deficit was $32 billion and with alone China its figure had crossed the $12 billion mark, making it impossible for Islamabad to sustain such a huge deficit with any single country. If it is not rescued swiftly, it will have no choice but to go to the IMF. So now it’s a fight for survival.

Pakistani negotiators claim that they had persuaded the Chinese side to insert clauses to protect Islamabad’s interest, given the increasing trade deficit with China, as part of the revised free-trade agreement draft. Now Pakistan will be able to invoke safety clauses if it finds that specific items are hurting its trade interests.

Former State Bank of Pakistan governor Dr Ishrat Husain has argued that Islamabad would have to seek market access from China equivalent to that of the ASEAN region as their tariff was less than Pakistan’s. This means, in essence, that our exports are at a disadvantage and cannot compete with those of other countries. But how much can this special treatment fix the problem? Can Pakistan’s exports go up if it gets the same as ASEAN countries? Dr Husain said it was difficult to speculate or give any figure.

Some numbers have been put forward by renowned economist Dr Akmal Hussain. In a recent study, he estimated that Pakistan’s trade could get a share of $45 billion by getting a one percent share out of the total volume of $4,447 billion on a per annum basis.

After this agreement, bilateral trade went up from $4 billion in 2007-8 to $15 billion for 2016-17 with Pakistan's exports at $1.4 billion and imports at $14 billion

Preferential trade agreements at the global level are aimed at achieving a quantum leap to promote trade. Pakistan has signed a total of seven Preferential Trade Agreements and Free Trade Agreements with different countries and regions. This includes the China-Pak FTA, the Malaysia-Pakistan Comprehensive Economic Partnership Agreement, South Asian Free Trade Agreement, Pakistan-Sri Lanka FTA, Pakistan-Indonesia PTA, Pakistan-Iran PTA and Pakistan-Mauritius PTA. It is currently negotiating free trade agreements with three more countries: Thailand, Turkey and Iran.

The preferential trade agreements promote trade through a gradual tariff reduction and provide better market access compared with other partners. There are many reasons, however, why Islamabad has failed to benefit from such agreements. Two major reasons are that it signs them without doing its homework and it is unable to generate exportable surpluses for a variety of reasons. One of them is the increasing cost of doing business in Pakistan.

Since 2000, a flurry of FTAs across the world were struck, especially in Asia. India signed 14, South Korea 16, China 17 and Vietnam 11. The Pak-China agreement in goods was signed on November 24, 2006 and was implemented from July 1, 2007. The agreement had two phases. Under the first phase, Pakistan reduced tariffs to zero duty on 2,423 tariff lines. (Tariff lines are products defined at a highly detailed level for the purpose of setting import duties.) China reduced the duty to zero on 2,681 tariff lines. The products in which China reduced its tariff by 50% included fish, dairy products, frozen orange juice, plastic products, rubber products, leather products, knitwear and woven garments.

After this agreement, bilateral trade went up from $4 billion in 2007-8 to $15 billion for 2016-17 with Pakistan’s exports at $1.4 billion and imports at $14 billion. Pakistan and China have held nine rounds of negotiations. For the second phase, China has proposed tariff elimination on 90% of the lines. Pakistan has requested that before embarking on this phase, it be granted unilateral market concessions on products of its primary interest in order to restore eroded market shares. China has FTAs with Chile, New Zealand, Singapore, Peru, Costa Rica and the ASEAN region.

When the ASEAN-China FTA went into effect in 2010, Pakistan registered a preference erosion on tariff lines that amounted to 79% of its export volume to China and the main tariff lines include cotton yarn, garments, leather and fish. Keeping China’s arrangement in view, these countries enjoyed incentivized tariffs and Pakistan lost out as with New Zealand 94% of the tariff lines are at zero duty, Malaysia has 94% of tariff lines at zero duty, Indonesia 93%, Thailand 93%, the Philippines 93%.

With Pakistan, only around 35% of the tariff lines are at zero duty under the FTA arrangement. So Pakistan is at a disadvantage. Pakistan could only export in 253 tariff lines, where average export value is $500 or more, which is around 3.3% of the total tariff lines (7,550). Pakistan mainly exported raw materials and intermediate products such as cotton yarn, woven fabric, grey fabric etc. The value-added products were missing from the incentive package.

Pakistan had proposed adjustments in the first phase during the initial meetings. The Chinese assured us that Pakistan’s concerns would be addressed in the second phase. It was agreed that negotiations would be held on a less than equal reciprocity principle in favour of Pakistan. The second phase requests and offer lists would be formulated independent of the first phase tariff liberalization.

For the second phase, Pakistan has proposed elimination of the tariff on 40% of lines, immediately to zero (including the MFN zero tariff) on the date of entry into force of the second phase. It proposed an elimination of tariff on 10 percent tariff lines to zero within five years from the date of entry into force. No reduction on tariff on 20 percent tariff lines was proposed.

Pakistan also proposed that before entering into the second phase, China grant an immediate concession on 35 to 40 tariff lines in Pakistan’s prime export interest. The Chinese proposed, however, that Pakistan may take longer and additional categories to achieve a 90% liberalization level. “If Pakistan is granted a concession equivalent to ASEAN’s in the top 20 products of its priority list, Pakistan’s exports to China would jump $257 million,” said one study done by the Ministry of Commerce. It is estimated that if Pakistan is granted complete liberalization by China, exports could go up by $542 million annually. Pakistan has also sought unilateral market concessions from China on cotton yarn, rice, nuts, plastic waste, leather, trousers, frozen fish and crabs before embarking on the second phase.

A senior official at the Ministry of Commerce said that the draft of the revised agreement was being readied but details could not be shared with the media. He said to wait a month.