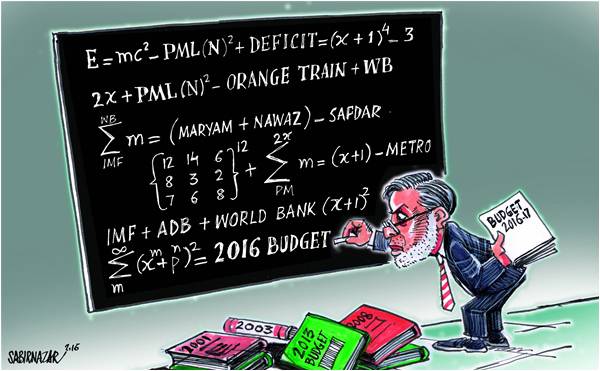

Finance Minister Ishaq Dar’s job is not enviable. He is a prisoner of several political, economic and national security constraints that severely circumscribe his ability to implement the deep structural reforms needed to put the economy on track for sustained long-term growth. Consider.

There is one fundamental issue that overhangs all others. That is each government’s inability or unwillingness to levy direct taxes on millions of income earning and rent seeking Pakistanis. Consequently, our Tax to GDP ratio at barely 13 per cent is insufficient – the global standard for emerging markets is above 20% — to meet our minimum necessary expenditures to uplift the economy, create jobs and alleviate poverty. Indeed, even when the FBR is able to meet its tax revenue targets – as it did this year – it does so by juggling with indirect taxes (direct tax target was short by nearly Rs 240 billion) whose burden is disproportionately felt by the poorer and lower income sections of the populace, thereby increasing real inequality. Unfortunately, there is no plan in Mr Dar’s budgetary proposals to effectively tax the income of millions of Pakistanis who operate in the black economy. Every government talks about it but doesn’t have the political will to crack down on tax evaders. Instead, existing taxpayers are pressurized to cough up more and more.

There is an allied structural issue. Nearly 60% of Pakistan’s GDP comes from the Services (entertainment, professional fees, etc) sector. But this barely accounts for 30% of total tax revenue. Similarly, the agriculture sector contributes above 20% of GDP but pays next to nothing in taxes because it remains in a perennially “depressed” condition with low productivity, low output, high input costs and pre-capitalist social and economic relations of production. Without radical land reform, biotech applications and realistic support policies for inputs and output, there is no scope for higher incomes and resultant taxes in this sector. But reform is precluded by a host of political and economic vested interests that are milking the status quo.

These revenue “constraints” inevitably put a brake on expenditures and therefore growth. As matters stand, all the tax revenue is gobbled up by two poachers: defense and debt servicing. In other words, all development expenditures must come out from more local and foreign debt or foreign investment and aid. The latter sources have been progressively drying up – foreign investment was barely US $1 billion last year because of our “national security” policies that have led to regional alienation, international isolation and domestic political instability. Corruption and bad governance in every ruling party has exacerbated the problem. So every government has to plug the gap between actual revenues and projected expenditures by deficit financing, ie, borrowing from the banks that are happy to lend, thereby crowding out the private sector. But this is a vicious circle and national debt as a proportion of GDP (over 60%) has been progressively rising over the decades. But such deficit financing is limited by two factors: the political necessity of keeping inflation low and donor programs (like those of the IMF that are needed for international balance of payment and currency stabilization reasons) that require it to come down to manageable proportions.

Therefore a degree of “fudging” to show an unduly healthy picture of the economy is to be expected. It begins even before the ink on the budget speech has dried in the form of supplementary budgetary grants for expenditure overruns and continues throughout the year. Defense expenditures and subsidies for loss making public sector enterprises or vested private sector entities like the sugar and fertilizer industry are the main beneficiaries (nearly Rs 240 billion this year). The government is also ever ready to manipulate GDP growth figures. Whenever there is a change of guard, the incoming regime deflates the growth figures of the outgoing government so that its own subsequent performance looks good in comparison. Independent think tanks claim GDP growth is about 3.1% over 2015-16 whereas the government is boasting 4.7%. The agriculture sector – whose cotton and rice output is the mainstay of our export regime — has actually declined by 2% but the government is putting a lid on its dismal performance for political reasons by claiming only stagnancy at minus 0.2 per cent! Is anyone unhappy with the budget?

The top export earners are relieved because their inputs and outputs remain out of the purview of duties and taxes. So too are government employees and pensioners because they have got a raise in emoluments above the rate of inflation. The military has got its usual pound of flesh. The bureaucracy’s perks and privileges are untouched. The subsidies of loss making public enterprises are intact, as are the profits of the fertilizer industry, automobile lobby and sugar barons. The retail trade sector that is a PMLN vote bank remains largely tax-immune. Only tens of millions of the poor, relatively powerless, impoverished and unemployed have been left to desperately fend for themselves on the margins of society.

There is one fundamental issue that overhangs all others. That is each government’s inability or unwillingness to levy direct taxes on millions of income earning and rent seeking Pakistanis. Consequently, our Tax to GDP ratio at barely 13 per cent is insufficient – the global standard for emerging markets is above 20% — to meet our minimum necessary expenditures to uplift the economy, create jobs and alleviate poverty. Indeed, even when the FBR is able to meet its tax revenue targets – as it did this year – it does so by juggling with indirect taxes (direct tax target was short by nearly Rs 240 billion) whose burden is disproportionately felt by the poorer and lower income sections of the populace, thereby increasing real inequality. Unfortunately, there is no plan in Mr Dar’s budgetary proposals to effectively tax the income of millions of Pakistanis who operate in the black economy. Every government talks about it but doesn’t have the political will to crack down on tax evaders. Instead, existing taxpayers are pressurized to cough up more and more.

There is an allied structural issue. Nearly 60% of Pakistan’s GDP comes from the Services (entertainment, professional fees, etc) sector. But this barely accounts for 30% of total tax revenue. Similarly, the agriculture sector contributes above 20% of GDP but pays next to nothing in taxes because it remains in a perennially “depressed” condition with low productivity, low output, high input costs and pre-capitalist social and economic relations of production. Without radical land reform, biotech applications and realistic support policies for inputs and output, there is no scope for higher incomes and resultant taxes in this sector. But reform is precluded by a host of political and economic vested interests that are milking the status quo.

These revenue “constraints” inevitably put a brake on expenditures and therefore growth. As matters stand, all the tax revenue is gobbled up by two poachers: defense and debt servicing. In other words, all development expenditures must come out from more local and foreign debt or foreign investment and aid. The latter sources have been progressively drying up – foreign investment was barely US $1 billion last year because of our “national security” policies that have led to regional alienation, international isolation and domestic political instability. Corruption and bad governance in every ruling party has exacerbated the problem. So every government has to plug the gap between actual revenues and projected expenditures by deficit financing, ie, borrowing from the banks that are happy to lend, thereby crowding out the private sector. But this is a vicious circle and national debt as a proportion of GDP (over 60%) has been progressively rising over the decades. But such deficit financing is limited by two factors: the political necessity of keeping inflation low and donor programs (like those of the IMF that are needed for international balance of payment and currency stabilization reasons) that require it to come down to manageable proportions.

Therefore a degree of “fudging” to show an unduly healthy picture of the economy is to be expected. It begins even before the ink on the budget speech has dried in the form of supplementary budgetary grants for expenditure overruns and continues throughout the year. Defense expenditures and subsidies for loss making public sector enterprises or vested private sector entities like the sugar and fertilizer industry are the main beneficiaries (nearly Rs 240 billion this year). The government is also ever ready to manipulate GDP growth figures. Whenever there is a change of guard, the incoming regime deflates the growth figures of the outgoing government so that its own subsequent performance looks good in comparison. Independent think tanks claim GDP growth is about 3.1% over 2015-16 whereas the government is boasting 4.7%. The agriculture sector – whose cotton and rice output is the mainstay of our export regime — has actually declined by 2% but the government is putting a lid on its dismal performance for political reasons by claiming only stagnancy at minus 0.2 per cent! Is anyone unhappy with the budget?

The top export earners are relieved because their inputs and outputs remain out of the purview of duties and taxes. So too are government employees and pensioners because they have got a raise in emoluments above the rate of inflation. The military has got its usual pound of flesh. The bureaucracy’s perks and privileges are untouched. The subsidies of loss making public enterprises are intact, as are the profits of the fertilizer industry, automobile lobby and sugar barons. The retail trade sector that is a PMLN vote bank remains largely tax-immune. Only tens of millions of the poor, relatively powerless, impoverished and unemployed have been left to desperately fend for themselves on the margins of society.