Pakistan is one the worst hit countries by terrorism and money laundering. It surfaces again in 2017 as one of the major countries listed in the US State Department’s annual money laundering and financial crimes volume, released this March as part of its International Narcotics Control Strategy Report.

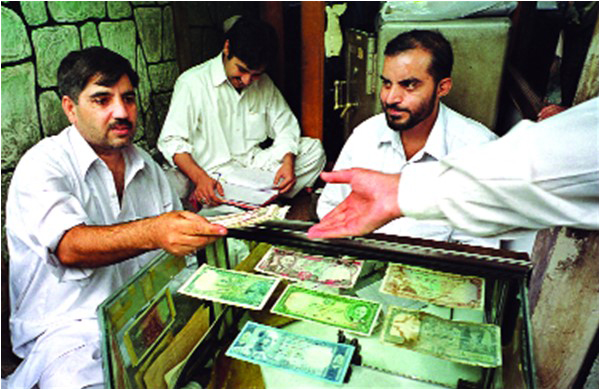

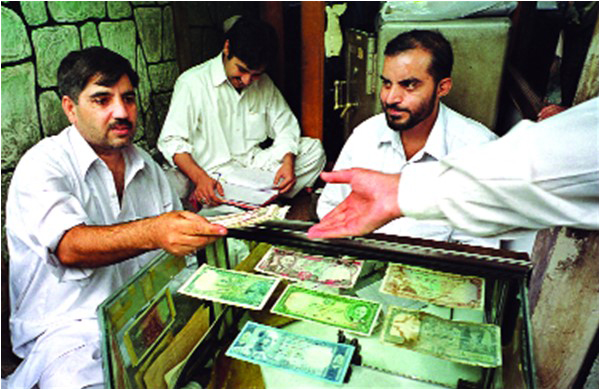

“Pakistan does not have firm control of its borders, which facilitates the flow of illicit goods and monies into and out of Pakistan,” says the report which was released this week. It notes that from January to December 2016, the Pakistani diaspora remitted $19.7 billion back to Pakistan via the formal banking sector, up 2.3% from 2015. “Though it is illegal to operate a hawala without a license in Pakistan, the practice remains prevalent because of poor ongoing supervision efforts and a lack of penalties levied against illegally operating businesses.” Unlicensed hawala and hundi operators are also common throughout the broader region and are widely used to transfer and launder illicit money through neighboring countries.

The Altaf Khanani group gets special mention in the report as a “money laundering organization” based in Pakistan. “The group, which was designated a transnational organized crime group by the United States in November 2015, facilitates illicit money movement between, among others, Pakistan, the UAE, US, UK, Canada, and Australia,” it says. “The Khanani MLO offers money laundering services to a diverse clientele, including Chinese, Colombian, and Mexican organized crime groups and individuals associated with designated terrorist organizations.”

The report does not appear to put a number on the financial loss to Pakistan from money laundering. But according to a statement by the then governor of the State Bank of Pakistan in 2013, the estimates are over $9 billion in funds illegally remitted outside Pakistan. There is enough evidence that militant groups earn through organised crime and receive major “donations” from “sympathizers” in and outside Pakistan.

No estimates of the money transferred abroad through foreign currency accounts, opened and protected under the Protection of Economic Reforms Act 1992, are available. A study by the SBP in 2010, The Size of Informal Economy in Pakistan, estimates that total size of the informal economy is around 30% of the total economy. This means that annually some 800 billion to 900 billion rupees are generated in Pakistan by the parallel economy, legal as well as illegal. Black money, generated through organised crime e.g. kidnapping for ransom, rent-seeking, smuggling in goods and narcotics trade is about Rs1,300 billion that does not appear in the SBP study but is documented in our Pakistan: Enigma of Taxation. Another study, Pakistan: Drug-trap to Debt-trap, estimates the total figure of informal economy at $95 billion.

The Council of Europe first used the term money laundering in 1980 in its ‘Recommendation No. R (80) 10 on Measures Against the Transfer and the Safekeeping of Funds of Criminal Origin’. In the US, the term was first officially used in a 1982 court ruling against the Colombian cocaine mafia. The first piece of legislation on money laundering (The Money Laundering Control Act) was enacted in 1986 in the US Federal State of Washington. This act envisaged severe sanctions against persons who duly failed to report monetary transactions in excess of US$10,000 or who failed to meet the obligation to keep receipts on business transactions involving amounts in excess of US$3,000.

Terrorist financing and money laundering, which are intrinsically linked, pose considerable threats to global peace and security. This twin menace assumed dangerous proportions after 9/11. Money is the terrorist’s bloodline in the war against humanity. The international community is struggling hard, without much success, to monitor and eliminate financial support being extended to them by their sympathizers.

International strategies and laws to fight money laundering and terror financing, developed during the last ten to fifteen years, are still considered to be in the nascent stages. Since organised crime syndicates have had far-reaching tentacles and influences in the financial systems for centuries, terrorists find no difficulty in exploiting the available infrastructure.

Sources of illegitimate money

The financial sector and the authorities need to collaborate and share information to unearth money laundering. In Pakistan, this kind of collaboration is almost non-existent. The main sources of illegitimate money in Pakistan are: smuggling of goods and people, drug trafficking, embezzlement, bribery, fraud, tax evasion and under/over invoicing. Some typical forms of money laundering are (a) the transfer of money through foreign currency accounts or hundi/hawala (b) the use of shell companies and/or accounts in tax havens to hide kickbacks, proceeds of over-invoicing abroad and (c) the whitening of money through business projects and investment in real estate. Add to this investment in real estate and money markets, employment of funds in development projects and investment in government securities.

Cracking down

Given the confidentiality of the information held by banks, it has been necessary to establish bridges between prosecution and enforcement authorities and financial institutions in order to allow this information to circulate while honoring confidentiality requirements. These bridges take the form of Financial Intelligence Units. Notwithstanding law enforcement’s access to this information, officials would not be in a position to identify, among the mass of information generated by the daily financial transactions of a financial sector institution, operations that are suspicious or that conceal money-laundering activities.

It is a well-established fact that the terrorist networks get millions of dollars every year from various sources using cover-up entities, and millions are transferred outside. The United Nations Office on Drugs and Crime (UNODC) estimates that terrorists and criminals launder trillions of dollars annually. The UNODC warns that “once illegal money has entered the global and financial markets, it becomes much harder to trace its origins, and the laundering of ill-gotten gains may perpetuate a cycle of crime”.

It is an admitted fact that despite the initiatives taken by the US, UN and many other countries, including Pakistan, terrorist financing and money laundering are increasing. On June 14, 2015, the governor of the SBP claimed before the Senate Committee that in the last five years, 300 cases of money laundering, including 34 big transactions made to suspected terrorists, were filed. He revealed that, “5775 money laundering cases has been reported to the bank over the past five years”.

Despite claims made by the SBP governor, the provisions of the AML Act, 2010 have been eclipsed by sections 5 and 9 of the Protection of Economic Reforms Act, 1992 and section 111(4) of Income Tax Ordinance, 2001 that give a free hand to money launderers. These provisions provide that no question would be asked if anybody remits ill-gotten funds into Pakistan through normal banking channels and surrendered foreign currency to the State Bank in exchange for rupees. The money can then be fearlessly invested in any legal business. For money laundering, one has just to pay a small premium to a money exchanger to fax a remittance.

The Federal Board of Revenue officials have no jurisdiction to hold an enquiry into foreign currency accounts (see judgement of the Lahore High Court in Hudabiya Engineering (Pvt.) Ltd. v. Pakistan and 6 others 1998 PTD 34). This is the real dilemma faced by Pakistan in countering money laundering and financing of terrorism due to contradictory laws and policies: frequent amnesty schemes.

In the presence of “protective” laws mentioned above, the provisions of Anti-Money Laundering Act of 2010 have rarely been invoked. In fact, this has become a dormant law. It baffles that when the presence of monstrous amounts of black money is so apparent, why is its criminal accumulation and generation not countered and the offenders go unpunished? People rightly ask whether it is on account of lack of political will, rampant corruption, ineffectiveness of law enforcement agencies, or defective laws. Terrorists and money launderers not only use hawala and hundi but exploit legal sanction available under section 111(4) of the Income Tax Ordinance, which says that if anybody brings money through normal banking channels, the tax authorities cannot ask questions about the “source.” The banks also take cover under sections 5 and 9 of the Protection of Economic Reform Act, 1992 to withhold information from tax authorities. Besides legal weaknesses, during the last 30 years, the NAB, FIA, ANF and FBR have not been able to set up a joint task force to book and prosecute the men and networks involved in money laundering. NAB, in fact, has been accepting ‘plea bargains’ offered by the corrupt, thereby minting a lot of money as ‘share’ in recovery. This is how we run state agencies on taxpayers’ money—the institutions that are supposed to punish tax cheats, criminals, rent-seekers, drug traffickers and terrorists exonerate them for a few bucks in plea bargains. Terrorist networks get millions daily through hundis and hawalas in addition to extortion money and proceeds of drug-arms deals. Many of them are even getting funds through normal banking channels in benami accounts. The inadequate reporting of such transactions by banks to the Financial Monitoring Unit (FMU) established under section 6 of the Anti Money Laundering Act, 2010 is a serious cause for concern. One wonders how our institutions and agencies, including the SBP, have been allowing a Pakistani exchange company to help tax evaders, terrorists and criminals to launder billions as alleged in the US State Department report. The SBP, until recently (February 2017), did not bother to install an automated system that could effectively monitor suspicious transactions. The press reported that it had inaugurated a system “for the automated detection of possible money laundering and terror financing that uses the banking system”. Prior to this the monitoring was done manually. The new automated system will track millions of transactions and be able to flag suspicious ones instead of the authorities having to wait for banks to manually generate reports, a task that was being performed by branch personnel until now. It is sort of like how credit card transactions can be flagged.

Pakistan defines money laundering in Section 3 of the Anti-Money Laundering Act, 2010. It can be investigated by NAB, the FIA, ANF or any agency the federal government decides.

In 2007, Pakistan promulgated the Anti-Money Law (AML) Ordinance, establishing regulations for AML and combating the terrorist financing and criminalizing money laundering. Under the ordinance, the Financial Monitoring Unit (FMU) was created. It is in charge of handling Suspicious Transaction Reports and Cash Transactions Reports.

On March 26, 2010, a new law, Anti-Money Laundering Act, 2010 (AML Act, 2010), was introduced. The FMU works NAB, the ANF, the customs intelligence and the FIA. The FIA deals with money laundering, terrorism, human smuggling and trafficking, and cybercrime, among others. The SBP and the Securities and Exchange Commission of Pakistan (SECP) are the primary financial regulators. Notwithstanding the absence of standalone AML legislation, the SBP and SECP have independently established AML units to enhance their oversight of the financial sector. The SBP has introduced regulations intended to be consistent with the Financial Action Task Force’s recommendations in the areas of a Know Your Customer policy, record retention, due diligence of correspondent banks, and the reporting of STRs.

Much more than this is needed to destroy the financial supply lines of terrorist networks. The terrorist networks cannot be destroyed, or even made ineffective, unless their financial sources are blocked nationally and internationally. Effective anti-money laundering laws and practical operations are a prerequisite.

The writers, lawyers and visiting faculty at the Lahore University of Management Sciences. They have written extensively on money laundering, the global arms-drug trade, terrorism and its financing. They are the authors of books such as Pakistan: From Hash to Heroin and its sequel Pakistan: Drug-trap to debt-trap

“Pakistan does not have firm control of its borders, which facilitates the flow of illicit goods and monies into and out of Pakistan,” says the report which was released this week. It notes that from January to December 2016, the Pakistani diaspora remitted $19.7 billion back to Pakistan via the formal banking sector, up 2.3% from 2015. “Though it is illegal to operate a hawala without a license in Pakistan, the practice remains prevalent because of poor ongoing supervision efforts and a lack of penalties levied against illegally operating businesses.” Unlicensed hawala and hundi operators are also common throughout the broader region and are widely used to transfer and launder illicit money through neighboring countries.

Provisions of the AML Act, 2010 have been eclipsed by sections 5 and 9 of the Protection of Economic Reforms Act, 1992 and section 111(4) of Income Tax Ordinance, 2001 that give a free hand to money launderers

The Altaf Khanani group gets special mention in the report as a “money laundering organization” based in Pakistan. “The group, which was designated a transnational organized crime group by the United States in November 2015, facilitates illicit money movement between, among others, Pakistan, the UAE, US, UK, Canada, and Australia,” it says. “The Khanani MLO offers money laundering services to a diverse clientele, including Chinese, Colombian, and Mexican organized crime groups and individuals associated with designated terrorist organizations.”

The report does not appear to put a number on the financial loss to Pakistan from money laundering. But according to a statement by the then governor of the State Bank of Pakistan in 2013, the estimates are over $9 billion in funds illegally remitted outside Pakistan. There is enough evidence that militant groups earn through organised crime and receive major “donations” from “sympathizers” in and outside Pakistan.

No estimates of the money transferred abroad through foreign currency accounts, opened and protected under the Protection of Economic Reforms Act 1992, are available. A study by the SBP in 2010, The Size of Informal Economy in Pakistan, estimates that total size of the informal economy is around 30% of the total economy. This means that annually some 800 billion to 900 billion rupees are generated in Pakistan by the parallel economy, legal as well as illegal. Black money, generated through organised crime e.g. kidnapping for ransom, rent-seeking, smuggling in goods and narcotics trade is about Rs1,300 billion that does not appear in the SBP study but is documented in our Pakistan: Enigma of Taxation. Another study, Pakistan: Drug-trap to Debt-trap, estimates the total figure of informal economy at $95 billion.

History of global laws

The Council of Europe first used the term money laundering in 1980 in its ‘Recommendation No. R (80) 10 on Measures Against the Transfer and the Safekeeping of Funds of Criminal Origin’. In the US, the term was first officially used in a 1982 court ruling against the Colombian cocaine mafia. The first piece of legislation on money laundering (The Money Laundering Control Act) was enacted in 1986 in the US Federal State of Washington. This act envisaged severe sanctions against persons who duly failed to report monetary transactions in excess of US$10,000 or who failed to meet the obligation to keep receipts on business transactions involving amounts in excess of US$3,000.

Terrorist financing and money laundering, which are intrinsically linked, pose considerable threats to global peace and security. This twin menace assumed dangerous proportions after 9/11. Money is the terrorist’s bloodline in the war against humanity. The international community is struggling hard, without much success, to monitor and eliminate financial support being extended to them by their sympathizers.

International strategies and laws to fight money laundering and terror financing, developed during the last ten to fifteen years, are still considered to be in the nascent stages. Since organised crime syndicates have had far-reaching tentacles and influences in the financial systems for centuries, terrorists find no difficulty in exploiting the available infrastructure.

Sources of illegitimate money

The financial sector and the authorities need to collaborate and share information to unearth money laundering. In Pakistan, this kind of collaboration is almost non-existent. The main sources of illegitimate money in Pakistan are: smuggling of goods and people, drug trafficking, embezzlement, bribery, fraud, tax evasion and under/over invoicing. Some typical forms of money laundering are (a) the transfer of money through foreign currency accounts or hundi/hawala (b) the use of shell companies and/or accounts in tax havens to hide kickbacks, proceeds of over-invoicing abroad and (c) the whitening of money through business projects and investment in real estate. Add to this investment in real estate and money markets, employment of funds in development projects and investment in government securities.

Cracking down

Given the confidentiality of the information held by banks, it has been necessary to establish bridges between prosecution and enforcement authorities and financial institutions in order to allow this information to circulate while honoring confidentiality requirements. These bridges take the form of Financial Intelligence Units. Notwithstanding law enforcement’s access to this information, officials would not be in a position to identify, among the mass of information generated by the daily financial transactions of a financial sector institution, operations that are suspicious or that conceal money-laundering activities.

It is a well-established fact that the terrorist networks get millions of dollars every year from various sources using cover-up entities, and millions are transferred outside. The United Nations Office on Drugs and Crime (UNODC) estimates that terrorists and criminals launder trillions of dollars annually. The UNODC warns that “once illegal money has entered the global and financial markets, it becomes much harder to trace its origins, and the laundering of ill-gotten gains may perpetuate a cycle of crime”.

It is an admitted fact that despite the initiatives taken by the US, UN and many other countries, including Pakistan, terrorist financing and money laundering are increasing. On June 14, 2015, the governor of the SBP claimed before the Senate Committee that in the last five years, 300 cases of money laundering, including 34 big transactions made to suspected terrorists, were filed. He revealed that, “5775 money laundering cases has been reported to the bank over the past five years”.

A study by the SBP in 2010, The Size of Informal Economy in Pakistan, estimates that total size of the informal economy is around 30% of the total economy. This means that annually some 800 billion to 900 billion rupees are generated in Pakistan by the parallel economy, legal as well as illegal

Despite claims made by the SBP governor, the provisions of the AML Act, 2010 have been eclipsed by sections 5 and 9 of the Protection of Economic Reforms Act, 1992 and section 111(4) of Income Tax Ordinance, 2001 that give a free hand to money launderers. These provisions provide that no question would be asked if anybody remits ill-gotten funds into Pakistan through normal banking channels and surrendered foreign currency to the State Bank in exchange for rupees. The money can then be fearlessly invested in any legal business. For money laundering, one has just to pay a small premium to a money exchanger to fax a remittance.

The Federal Board of Revenue officials have no jurisdiction to hold an enquiry into foreign currency accounts (see judgement of the Lahore High Court in Hudabiya Engineering (Pvt.) Ltd. v. Pakistan and 6 others 1998 PTD 34). This is the real dilemma faced by Pakistan in countering money laundering and financing of terrorism due to contradictory laws and policies: frequent amnesty schemes.

In the presence of “protective” laws mentioned above, the provisions of Anti-Money Laundering Act of 2010 have rarely been invoked. In fact, this has become a dormant law. It baffles that when the presence of monstrous amounts of black money is so apparent, why is its criminal accumulation and generation not countered and the offenders go unpunished? People rightly ask whether it is on account of lack of political will, rampant corruption, ineffectiveness of law enforcement agencies, or defective laws. Terrorists and money launderers not only use hawala and hundi but exploit legal sanction available under section 111(4) of the Income Tax Ordinance, which says that if anybody brings money through normal banking channels, the tax authorities cannot ask questions about the “source.” The banks also take cover under sections 5 and 9 of the Protection of Economic Reform Act, 1992 to withhold information from tax authorities. Besides legal weaknesses, during the last 30 years, the NAB, FIA, ANF and FBR have not been able to set up a joint task force to book and prosecute the men and networks involved in money laundering. NAB, in fact, has been accepting ‘plea bargains’ offered by the corrupt, thereby minting a lot of money as ‘share’ in recovery. This is how we run state agencies on taxpayers’ money—the institutions that are supposed to punish tax cheats, criminals, rent-seekers, drug traffickers and terrorists exonerate them for a few bucks in plea bargains. Terrorist networks get millions daily through hundis and hawalas in addition to extortion money and proceeds of drug-arms deals. Many of them are even getting funds through normal banking channels in benami accounts. The inadequate reporting of such transactions by banks to the Financial Monitoring Unit (FMU) established under section 6 of the Anti Money Laundering Act, 2010 is a serious cause for concern. One wonders how our institutions and agencies, including the SBP, have been allowing a Pakistani exchange company to help tax evaders, terrorists and criminals to launder billions as alleged in the US State Department report. The SBP, until recently (February 2017), did not bother to install an automated system that could effectively monitor suspicious transactions. The press reported that it had inaugurated a system “for the automated detection of possible money laundering and terror financing that uses the banking system”. Prior to this the monitoring was done manually. The new automated system will track millions of transactions and be able to flag suspicious ones instead of the authorities having to wait for banks to manually generate reports, a task that was being performed by branch personnel until now. It is sort of like how credit card transactions can be flagged.

Pakistan laws on money laundering

Pakistan defines money laundering in Section 3 of the Anti-Money Laundering Act, 2010. It can be investigated by NAB, the FIA, ANF or any agency the federal government decides.

In 2007, Pakistan promulgated the Anti-Money Law (AML) Ordinance, establishing regulations for AML and combating the terrorist financing and criminalizing money laundering. Under the ordinance, the Financial Monitoring Unit (FMU) was created. It is in charge of handling Suspicious Transaction Reports and Cash Transactions Reports.

On March 26, 2010, a new law, Anti-Money Laundering Act, 2010 (AML Act, 2010), was introduced. The FMU works NAB, the ANF, the customs intelligence and the FIA. The FIA deals with money laundering, terrorism, human smuggling and trafficking, and cybercrime, among others. The SBP and the Securities and Exchange Commission of Pakistan (SECP) are the primary financial regulators. Notwithstanding the absence of standalone AML legislation, the SBP and SECP have independently established AML units to enhance their oversight of the financial sector. The SBP has introduced regulations intended to be consistent with the Financial Action Task Force’s recommendations in the areas of a Know Your Customer policy, record retention, due diligence of correspondent banks, and the reporting of STRs.

Much more than this is needed to destroy the financial supply lines of terrorist networks. The terrorist networks cannot be destroyed, or even made ineffective, unless their financial sources are blocked nationally and internationally. Effective anti-money laundering laws and practical operations are a prerequisite.

The writers, lawyers and visiting faculty at the Lahore University of Management Sciences. They have written extensively on money laundering, the global arms-drug trade, terrorism and its financing. They are the authors of books such as Pakistan: From Hash to Heroin and its sequel Pakistan: Drug-trap to debt-trap