The agriculture sector serves as the backbone of Pakistan's economy. Although the country has developed in the manufacturing and services sectors, agriculture still remains one of the most significant components of the country's economic mix. As a result, it is even more concerning when one observes the scale of systematic negligence in the sector, which has prevented it from reaching anywhere close to its potential.

The publication of the "The State of Pakistan's Agriculture 2023" report by the Pakistan Business Council (PBC) highlights the many issues facing the sector. The report discusses problems such as low crop yield, a broken supply chain, slow adoption of information technology, limited access to capital, food security, and challenges related to irrigation, water scarcity, and climate change.

Current State

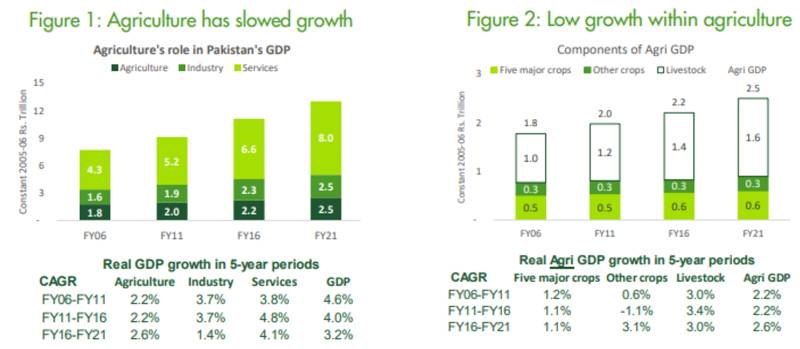

According to the PBC report, the growth of the agriculture sector has slowed over time and is now approaching stagnation. The main cause of this slowdown are the five cash crops that occupy a significant amount of the country's agricultural land, labor, and resources, but have failed to yield substantial results.

Source: PBC

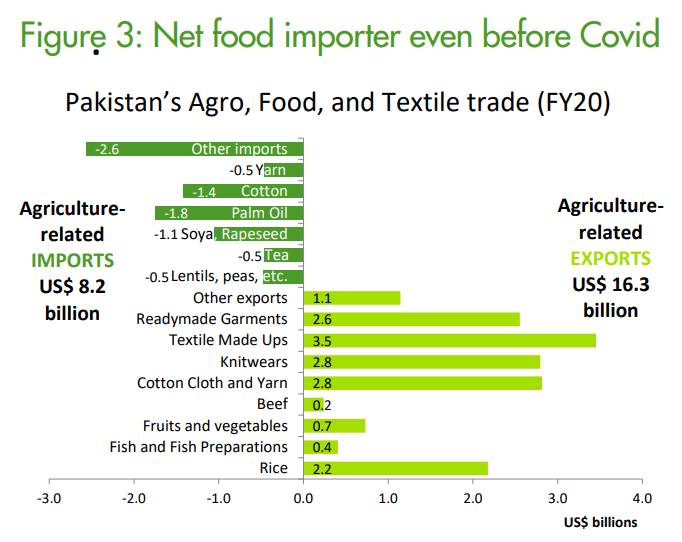

Further, the rapid pace of climate change poses a threat to Pakistan as a whole and specifically to the agricultural sector. Extended heatwaves and flooding events are likely to significantly impact crop yield and worsen the existing crisis. In addition, the alarming rate of population growth in the country further intensifies the food security issue. Being a net importer of food commodities, Pakistan is also at risk of facing food inflation due to rising global prices.

Source: PBC

Breaking the Cycle

However, for the revival of the agricultural sector, certain key policy initiatives need to be implemented. According to the PBC report, the country must enhance its crop yield to at least regional averages. To achieve this, a crucial starting point would be amending the Seed Act to provide regulatory and legal support for private seed companies to develop superior seed varieties that can maximize output.

Further, expansion of cultivated land of fruits and vegetables backed by a reliable cold chain infrastructure would serves as a lucrative revenue stream as well as a method of preserving water. Additionally, it is crucial to provide farmers with greater protection against risks such as floods and exploitation by middlemen. Furthermore, the conversion of farm products into higher value-added goods through processing can serve as a means of amplifying the sector's output.

The report also highlights the importance of investing in agri-tech and improving the country’s irrigation system. “Processors who have invested deeply in ‘backward integration’ to form deeper connections with farmers through contract farming have already set good examples: Rafhan in maize, JDW in sugarcane, Nestle in milk, etc. But scaling up the adoption of technology across Pakistan’s small-to-medium-sized farms requires another type of entity: the farm machinery service provider. Service providers large and small, formal and informal, must be supported actively to upgrade cultivation at both large and small farms. Service providers are the entities which can facilitate farmers’ shift to cultivation practices that complement mechanization.

A shift from scrap machines to a national fleet of new machines is needed to move Pakistan towards local manufacturing of globally competitive farm machinery. Training is a must,” read the report.

On the efficiency of irrigation, Zeeshan Hasib Baig, Country General Manager at Syngenta, one of Pakistan’s largest agriculture inputs and services providers, stated in an interview, “Firstly, we need to strategize on cultivating water efficient crops. Further the upgradation of Pakistan’s canal system is long due while there also needs to be taxation on water usage to prevent wastage.”

Access to credit

However, one of the primary challenges faced by the sector is the dominance of middlemen in commodity trade and limited access to credit from banks. As per the PBC report, only a quarter of farmers have been able to break free from middlemen, who connect the sale of previous crop harvest with the purchase of next crop inputs, resulting in delayed payments at higher prices.

Banks, on the other hand, fall short in providing enough credit to farmers, with complex documentation requirements and a lack of knowledge hindering access to loans. As a result, many farmers resort to informal borrowing loan sharks and are subsequently exploited.

“A significant number of farmers lack land holdings, making it difficult for them to secure loans from financial institutions due to the absence of collateral. Banks typically do not accept crops as collateral. Consequently, these individuals are often left with no choice but to turn to local loan sharks for financing their cultivation activities.” remarked, Umar Saif, interim Federal Minister for IT, during an interview.

To address this issue, the government has recently made an allocation of Rs.5 billion in the budget to provide concessional loans that support the growth of the agro industry. Additionally, the Prime Minister's Youth Business and Agriculture Loan Scheme will offer easy loans to small and medium-scale farmers, with a subsidy of Rs.10 billion earmarked for markup rates in the upcoming financial year. Further, the government has planned to provide low-interest loans to small farmers in collaboration with provincial governments, with an allocation of Rs.10 billion for this specific purpose.

However, there is still a long road ahead in terms of reviving the agriculture sector. Nevertheless, it is encouraging to see that the state machinery is now prioritizing the sector, as they are finally recognizing its potential.