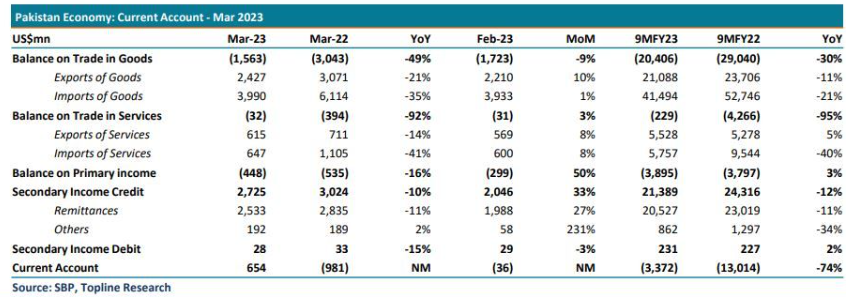

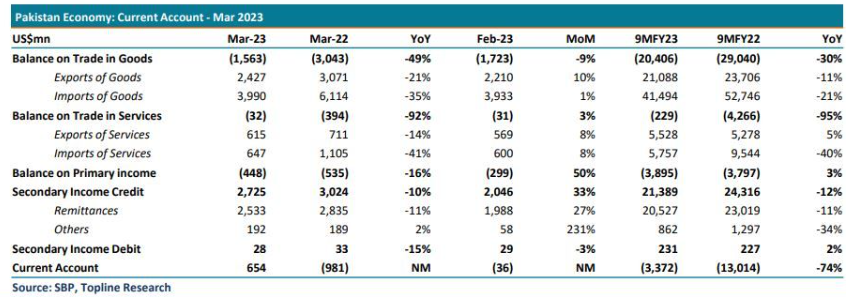

The State Bank of Pakistan (SBP) released its report on the country's Current Account figures for March 2023, which revealed a surplus of $654 million. This marks a significant turnaround from the previous month, which saw a deficit of $36 million. This can be attributed to the government's implementation of rigorous monetary and fiscal policies, as well as administrative measures. It is noteworthy that this is the first time since November 2020 that a surplus has been recorded.

Additionally, the numbers show that the Current Account Deficit (CAD) for the first nine months of Fiscal Year (FY) 2023 amounted to $3.37 billion, compared to $13 billion in the same period of FY22.

“The balance of Trade in Goods and Services improved considerably and clocked in at US$1,595mn in March 2023 against a Balance in Trade of Goods and Services of US$3,437mn in March 2022. Even on a MoM basis, Balance of Trade in Goods improved by 9%,” read a report by Topline Securities.

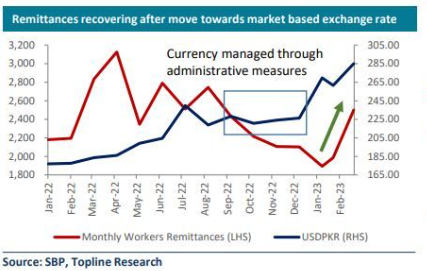

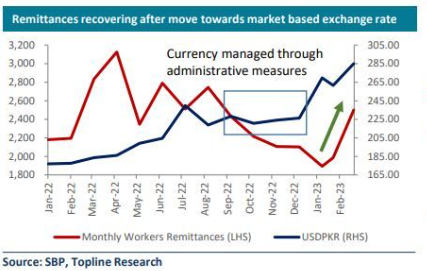

“Workers’ remittances clocked in at US$2,533 in March 2023 against US$2,835mn in March 2022. Remittances have improved by 27% MOM. The trend in remittances is improving after the 10-15% gap between official and unofficial rates of local currency has been eliminated,” it further added.

Therefore, the hike in remittances and the Ramzan and Eid factor also played their part in easing the current account pressures. Head of Equity Research at Ismail Iqbal Securities, Fahad Rauf tweeted, “Bangladesh also witnessed a sharp fall in remittances when the gap between the open market and the official rate rose to 15 Taka per dollar. They increased the exchange rate for remittances, and the impact has been positive.”

Read More: Dwindling Remittances Figures Are A Self-Inflicted Wound

Exports clocked in at $2.4 billion, down by 21 percent compared to March 2022. This can be primarily attributed to the decrease in global demand and commodity prices. While imports in March 2023 were recorded at $3.9 billion down from $6.1 billion in March 2022. This decline can be attributed to a weaker exchange rate and administrative measures to restrict imports.

However, the balance of payments situation is likely to remain under stress due to a significant number of debt repayments materializing in the near-term. As per the World Bank’s Pakistan Development Update April 2023, “Pakistan’s external financing needs are projected to be, on average, US$28.9 billion per year (8 percent of GDP) during FY23-FY25, including IMF repayments, maturing Eurobonds, and repayments against Chinese commercial loans.”

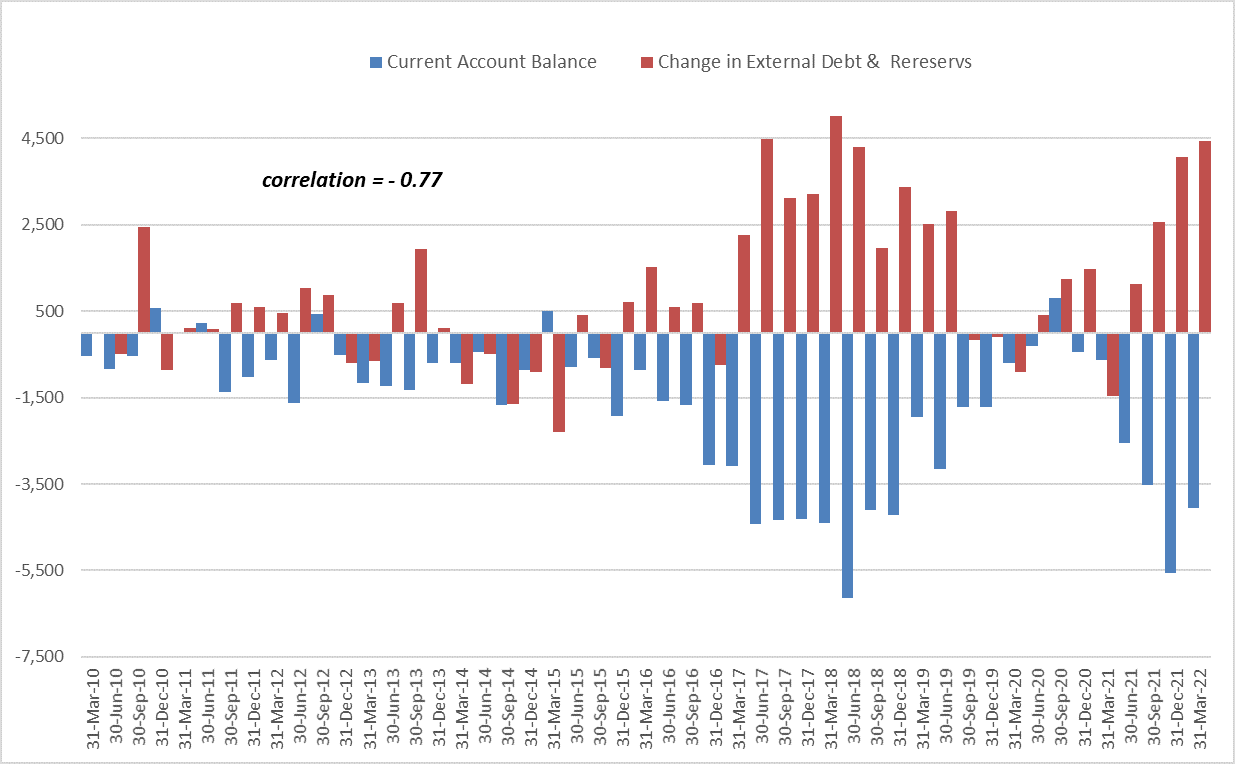

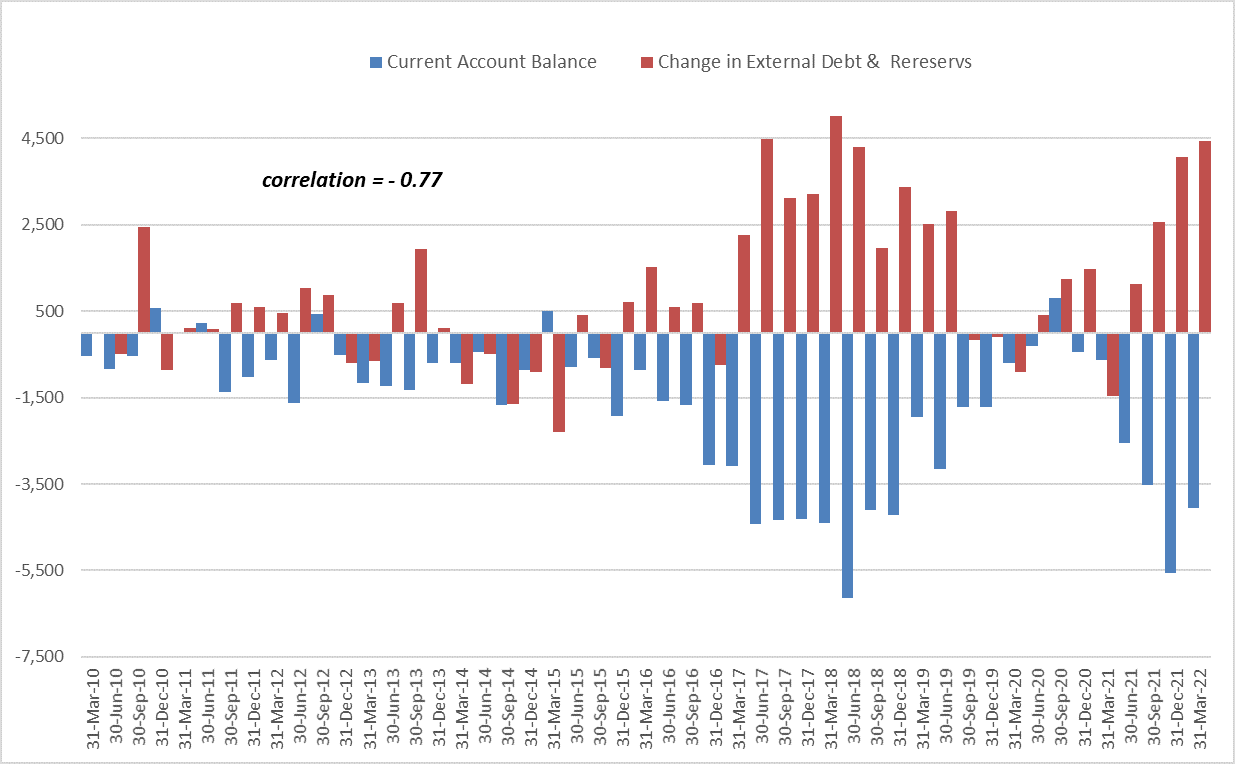

Dr. Ahmed Pirzada, senior lecturer at the University of Bristol, UK, and a member of the Economic Advisory Group (EAG), Pakistan, in a Twitter thread, explained the relationship between fiscal deficits, external borrowing, and current account deficit (CAD) in Pakistan over the past decade. He stated that between 2010-13, despite high fiscal deficits and commodity prices, CAD remained under control due to negligible external borrowing, resulting in less spending on imports. In contrast, between 2016-18 and 2021-22, an increase in external borrowing led to a stable exchange rate and high CAD. He highlighted that increasing the availability of dollars in the market had a direct and strong correlation with CAD.

However, the government would eventually move towards eliminating imports and administrative restrictions to restore economic growth, resulting in the reoccurrence of the current account deficit.

Additionally, the numbers show that the Current Account Deficit (CAD) for the first nine months of Fiscal Year (FY) 2023 amounted to $3.37 billion, compared to $13 billion in the same period of FY22.

“The balance of Trade in Goods and Services improved considerably and clocked in at US$1,595mn in March 2023 against a Balance in Trade of Goods and Services of US$3,437mn in March 2022. Even on a MoM basis, Balance of Trade in Goods improved by 9%,” read a report by Topline Securities.

“Workers’ remittances clocked in at US$2,533 in March 2023 against US$2,835mn in March 2022. Remittances have improved by 27% MOM. The trend in remittances is improving after the 10-15% gap between official and unofficial rates of local currency has been eliminated,” it further added.

Therefore, the hike in remittances and the Ramzan and Eid factor also played their part in easing the current account pressures. Head of Equity Research at Ismail Iqbal Securities, Fahad Rauf tweeted, “Bangladesh also witnessed a sharp fall in remittances when the gap between the open market and the official rate rose to 15 Taka per dollar. They increased the exchange rate for remittances, and the impact has been positive.”

Read More: Dwindling Remittances Figures Are A Self-Inflicted Wound

Exports clocked in at $2.4 billion, down by 21 percent compared to March 2022. This can be primarily attributed to the decrease in global demand and commodity prices. While imports in March 2023 were recorded at $3.9 billion down from $6.1 billion in March 2022. This decline can be attributed to a weaker exchange rate and administrative measures to restrict imports.

However, the balance of payments situation is likely to remain under stress due to a significant number of debt repayments materializing in the near-term. As per the World Bank’s Pakistan Development Update April 2023, “Pakistan’s external financing needs are projected to be, on average, US$28.9 billion per year (8 percent of GDP) during FY23-FY25, including IMF repayments, maturing Eurobonds, and repayments against Chinese commercial loans.”

Dr. Ahmed Pirzada, senior lecturer at the University of Bristol, UK, and a member of the Economic Advisory Group (EAG), Pakistan, in a Twitter thread, explained the relationship between fiscal deficits, external borrowing, and current account deficit (CAD) in Pakistan over the past decade. He stated that between 2010-13, despite high fiscal deficits and commodity prices, CAD remained under control due to negligible external borrowing, resulting in less spending on imports. In contrast, between 2016-18 and 2021-22, an increase in external borrowing led to a stable exchange rate and high CAD. He highlighted that increasing the availability of dollars in the market had a direct and strong correlation with CAD.

Tweeted by Dr. Pirzada

However, the government would eventually move towards eliminating imports and administrative restrictions to restore economic growth, resulting in the reoccurrence of the current account deficit.