The Election Commission of Pakistan has officially confirmed that the general elections will take place in the last week of January, effectively ending any speculation about potential delays. The voting will occur after the constituencies have been redrawn following the new Census, as stated in the official announcement. This news has generated positive sentiment among investors, leading to a gain in the KSE-100 index over the past two days.

In other news, the Asian Development Bank (ADB) highlighted the potential significance of the upcoming general elections in boosting confidence in the economy and contributing to its recovery in its "Asian Development Outlook" report earlier this week.

Parallel to this development, there has been noise around stabilizing the exchange rate and bringing it down to 250. This, if executed, could lead to a major relief in terms of inflation for the general population.

However, it's important to note that any true economic improvement will require concrete changes in the country's underlying reality rather than just a shift in perception. To gain a comprehensive understanding of the current situation and outlook, it's necessary to analyze whether the elections can bring about significant tangible changes or not.

The economy as it stands

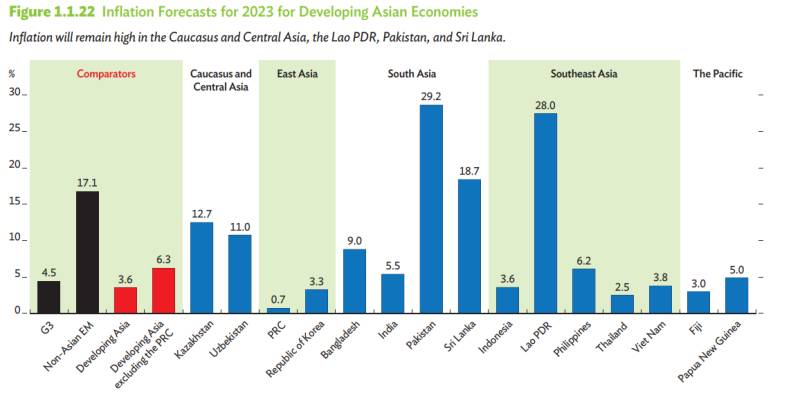

The ADB report highlighted that in fiscal year (FY) 2023 the floods, price shocks, and political instability led to a decline in economic growth, higher inflation, a weaker currency, and reduced reserves. To address these difficulties, the government implemented stricter fiscal and monetary policies.

Prior to the challenges in 2023, Pakistan experienced two years of robust growth, driven by domestic demand and lending schemes. However, imbalances grew, leading to a current account deficit and inflation. In 2023, shocks and policy deviations worsened economic volatility. Floods, political unrest, high global prices, and slower global growth affected sectors and triggered inflation.

Despite expansionary policies, financing sources decreased and import controls restricted production. In FY 2023, growth was minimal, and inflation reached a five-decade high. Various sectors experienced declines while exports and imports decreased. Foreign currency liquidity tightened, reserves declined, and foreign direct investment decreased.

Moving forward, the regional development bank emphasized that stability and growth recovery will rely on strict adherence to an economic adjustment program. The outlook for Pakistan's economy in fiscal year 2024 is anticipated to be moderate growth but with significant downside risks.

Source: ADB

The Elections

Beyond the economic turmoil, the country is experiencing a severely fractured political landscape that has eroded confidence for many. As the general polls approach, one of the country's most popular political leaders, Imran Khan, is confined behind bars in Attock Jail, while other political players have hardly commenced their election campaigns. Moreover, the pressures on these players are compounded by the likely restoration of anti-corruption cases following the Supreme Court's orders.

On the contrary, radical parties like Tehreek-I-Labaik Pakistan (TLP) have intensified their activities against minorities, aiming to shape a narrative for their election campaign. TLP is also likely to function as a pressure group for whichever party comes to power following the general elections.

Although many anticipate that the return of Nawaz Sharif, the head of PML-N, would bring the much-needed impetus to the lackluster political scene, the reality is starkly different. In his editorial, Raza Rumi argues that upon return, Nawaz Sharif is likely to face numerous battles on multiple fronts, one of the most significant being to rein in the firm hold the military establishment currently has on the country—a hold that was allowed to consolidate during the tenure of the PDM government led by his brother.

Parallel to the chaos, there is an economic conundrum that business and economy journalist Khurram Husain points towards in his article for Dawn. He argues that relying on a multibillion-dollar bailout to postpone the inevitable reckoning would only lead to a more painful adjustment in the long term. Additionally, Husain emphasizes that the current solutions offered are either unconvincing or unsustainable.

Therefore, according to Husain, a different narrative may emerge that focuses on the burden placed on the people through interest-based relations with creditors and questions the government's priorities. This will amplify the voices calling for the government to explore some form of debt relief, although it may be a difficult path to pursue.

Source: Chase Securities

This is precisely the reason why an unsubstantiated claim, such as bringing the dollar to 250, might not hold true. It is evident that the country is reliant on external economic support to sustain economic cohesion, indicating the need for uninterrupted assistance.

Therefore, irrespective of the electoral outcome, Pakistan is likely to encounter repeated instances of political instability and protests due to the adverse economic situation. The country's economic instability, stemming from years of governmental mismanagement, corruption, and a lack of implementation of crucial structural reforms, will present significant hurdles in restoring order and attracting substantial investments.