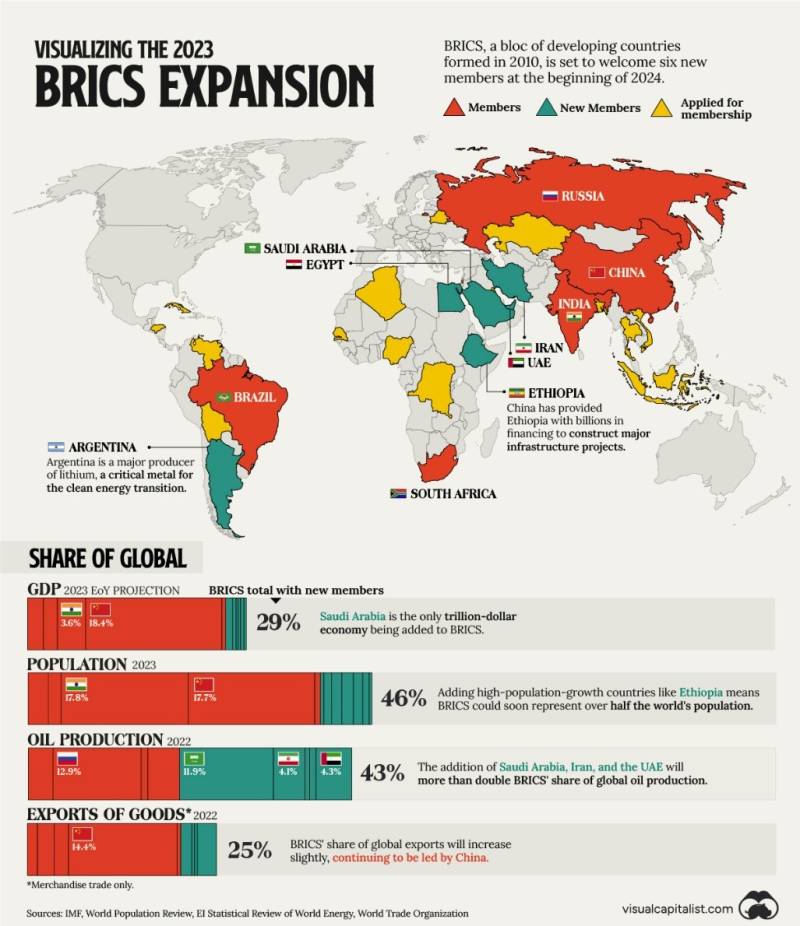

The BRICS (Brazil, Russia, India, China, and South Africa) nations are gradually establishing themselves as a viable alternative to the dominant western-centric global financial system. Additionally, the recent inclusion of Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates further strengthens their position relative to the American-led world economic order.

However, it should be noted that significant changes in the global financial system are still a distant goal. Many countries in the Global South are nonetheless actively seeking alternatives to avoid aligning themselves in a potential Cold War scenario, which makes BRICS an attractive option.

The recent additions to the bloc aim to enhance BRICS' influence as a platform of nations in the Global South. Many of these countries feel that they have been dealt a heavy hand by international institutions that are largely dominated by the United States and other wealthy Western nations.

In early 2022, western sanctions were imposed on Russia due to its invasion of Ukraine, resulting in almost half of Russia's foreign currency reserves being frozen. Additionally, major Russian banks were removed from SWIFT, an international payments network used by banks. This situation further heightened concerns in the developing world about the unchecked power of the United States over the global financial system.

Furthermore, the consistent interest rate hikes by the US Federal Reserve have had a significant impact on the developing world. According to the economists at the International Monetary Fund (IMF), developing countries have faced challenges in paying higher interest rates on their dollar-denominated debt, as well as dealing with the exchange rate effects of a strong dollar. These circumstances have compelled some countries to consider borrowing in local or other currencies, driven by economic considerations.

The increased attention surrounding the expansion of the BRICS bloc arises from its members actively seeking to disrupt the existing dominance of the US dollar. Suggestions have been made that the inclusion of significant oil-exporting nations could potentially undermine American economic control.

However, it is important to consider that the influence of the US dollar in the oil trade is primarily driven by market dynamics, and currently, there are no viable alternative currencies. The prospect of a unified BRICS currency remains uncertain, and in order to effectively challenge the current order, the bloc would need to establish reliable and trusted financial institutions to inspire confidence.

The stability and widespread acceptance of the US dollar in global markets provide advantages, such as predictability, ease of use, and lower transaction costs. While the potential introduction of a new BRICS currency may address some challenges, it is unlikely to completely resolve all existing issues. Furthermore, there are varying degrees of commitment among BRICS members regarding a shift away from the dollar. While countries like Russia, China, and Iran are eager to reduce the impact of costly financial sanctions imposed by the US, other nations may be more hesitant to bear the associated costs of transitioning away from the dollar.

As part of their efforts to diversify the global financial landscape, the BRICS nations established the New Development Bank (NDB) in 2014, aiming to provide an alternative to the IMF and World Bank. One of the main objectives of the NDB is to reduce member countries' vulnerability to fluctuations in the dollar exchange rate by increasing lending in local currencies. Since its inception, the NDB has successfully financed nearly 100 projects, with a focus on important infrastructure sectors such as water, transportation, clean energy, and digital development.

However, it is worth noting that a significant portion of the approved loans, approximately two-thirds amounting to nearly $33 billion, were still denominated in dollars.

As the NDB expands its membership and strengthens its capital base, it is expected to play an increasingly significant role in development finance within the BRICS framework. Projections suggest that by the mid-2030s, the NDB's loan stock could reach a substantial $350 billion, potentially surpassing the financing capacity of the World Bank.

Despite its massive economic power, the group is still unlikely to overturn the global financial order in the near future. The founding members of BRICS, China and India, have differing viewpoints on various issues, and other members like South Africa and Brazil maintain close relationships with the West. As a result, while the bloc and its economic tools, such as the currency, may offer alternatives to the Global South, similar to how the Euro and Eurozone did for Europe, they are not expected to completely overshadow the influence of the West.