Recently, Gohar Ejaz, a prominent textile industrialist and a former federal minister in the caretaker government, took to the media to mount a campaign against the capacity payments paid to independent power producers (IPPs). However, Pakistan’s energy crisis is a much bigger issue than just a fight for rents between the textile lobby and the energy producers. The crisis lies at the core of Pakistan’s worsening debt crisis but more importantly, it is playing havoc with the lives of millions of Pakistanis.

Pakistan is in a debt trap. The interest paid on federal government debt as a percentage of net revenues was 120.9% in 2023-24, the worst in the world, much higher than Sri Lanka’s ratio at 78%, which was the second highest in the world. Taxes are budgeted to go sharply up by 39% in the current fiscal year, at a time when the people are already reeling from a high incidence of indirect taxes because Pakistan’s wealthy pay little direct taxes on income from property, agriculture, retail or whole trade and most of the burden of taxes on the formal sector is passed on to the consumers.

During the last financial year of July 2023-June 2024, the total electricity costs to the end consumers rose by 26% to Rs.3.79 trillion (equivalent to 3.6% of the GDP) including Rs. 630 bn in taxes collected through the electricity bills. The costs to the consumers increased despite a fall in the energy charge (cost of operations including raw materials) due to a 60% rise in the capacity payments and a 42% increase in taxes collected through electricity bills. Residential customers with around 40% of the total electricity consumption represent the country's single largest segment of electricity consumers.

| 2022-23 | 2023-24 | % Change | |

| Energy charge | 1,251 | 1,048 | -16% |

| Capacity charge | 1,321 | 2,112 | 60% |

| Sub-total electricity charges | 2,572 | 3,160 | 23% |

| Salex tax | 293 | 411 | 40% |

| Income tax | 150 | 219 | 46% |

| Sub-total - Tax collection through electricity bills | 443 | 630 | 42% |

| Total Electricity Cost | 3,015 | 3,790 | 26% |

| Tax collection as % of electricity charges | 17% | 20% |

There is a lot of noise about the impact of devaluation and raw material prices on electricity prices. Hence, it is important to highlight that during the 3 years to FY 2023-24, total energy charge increased by 54.6%, the total capacity payments rose by 165.3% and the total bills (excluding taxes) increased by 114.4% although the Pakistan Rupee devalued by just 43.6% against the USD based on the average exchange rates for the periods. There has to be an independent inquiry into the reasons for this. This inquiry should include a forensic examination of the records of all the IPPs (Government, Chinese, and Local Private) and of the claims submitted by the IPPs for the charges to verify if they were made according to the terms of the agreements.

Writing in the Financial Times (FT) July 22, Murtaza Syed, a former IMF and State Bank of Pakistan official, warned the measures the Pakistan government is taking to secure a $7 billion emergency bailout from the IMF threaten to spark country-wide social unrest, while burying Pakistan under a crushing mountain of debt.

It is the common people who are helping repay the loans through taxes. In a typical domestic bill, the government adds 24% taxes to the electricity bill. It adds 37% taxes to commercial and 27% to industrial bills. They are also expected to help repay the loans used to build surplus power generation capacity that was not needed in the first place. Second, the capacity was heavily reliant on imported fuel (coal, gas) and was built through highly generous terms offered to “investors”, who used excessive levels of foreign debt. The energy policy made Pakistan’s electricity prices dangerously vulnerable to international energy prices and currency devaluation risk. The producers were guaranteed profits and shared no risks. The people have been ripped off twice: by the energy producers and the government and by the elites who have enjoyed subsidies, dressed up as incentives, for a long time.

Historic and Strategic Blunders

On April 21, 2020, an Inquiry Report prepared by a committee formed by the PTI government revealed some important facts as follows:

· 16 independent power-producing companies (IPPs) invested around Rs60 billion and earned over Rs400 billion in profits in a period ranging from two to four years.

· The report highlighted 7 private-sector IPP companies making excessive Returns on Equity (RoE) varying between 31% to as much as 87%.

· The Report pointed out excess capacity and recommended a moratorium on new capacity and investments.

· The report reported the distribution companies' lack of performance putting its cumulative losses and receivables at more than Rs 1 trillion out of which 55% were private sector bills defaulters; 18.2% were to be paid by federal and provincial governments; 10.7% were unpaid subsidies while IPPs and KE had to pay another 8.4%.

I made a presentation as a guest lecturer at an energy policy and climate change course at John Hopkins University in September 2018 and concluded it by asking the following questions:

It seems the cost of learning those lessons is close to 2 per cent of the GDP or currently over $7 billion a year.

Pakistan’s current power generation installed capacity is 45,885 MW and the dependable generation capacity is around 43,749 MW. During Pakistan’s summers, the total power demand surges to over 29,000 MW, while in winter, it stands at a comparatively modest 12,000 MW.

The UK’s Financial Times, in a report published on 17 May 2017, warned about the excess capacity stating that the capacity to be generated by CPEC projects would repair Pakistan’s supply gap twice over: “Peak electricity demand in Pakistan is 6 gigawatts greater than it can generate — equivalent to about 12 medium-sized coal power plants. Blackouts in many parts of the country last for several hours a day. To meet this shortfall China is expected to spend more than $35bn — about two-thirds of the entire CPEC budget — building or helping to construct 21 power plants, which will be mainly fuelled by coal. The combined 16GW of capacity that they could provide would repair Pakistan’s supply gap twice over.”

Excess Capacity Was Built With Indecent Haste At a High Cost

On May 25, 2017, National Transmission and Despatch Company (NTDC) CEO Dr Faiz Chaudhry told a meeting presided over by Minister for Water and Power Khawaja Muhammad Asif, that Pakistan was heading towards a ‘capacity trap’ because of loads of additional generation capacity currently in the pipeline that would add to the circular debt crisis.

Ironically, the transmission and distribution capacity had been stalled at approximately 22,000MW for years while the billions were poured into building additional generation capacity.

Pakistan’s current power generation installed capacity is 45,885 MW and the dependable generation capacity is around 43,749 MW. During Pakistan’s summers, the total power demand surges to over 29,000 MW, while in winter, it stands at a comparatively modest 12,000 MW. According to the NEPRA’s State of the Industry Report 2023, the generation capacity is expected to exceed peak demand projections for at least the next four years as the NEPRA is projecting peak demand of around 34,000 MW in 2028.

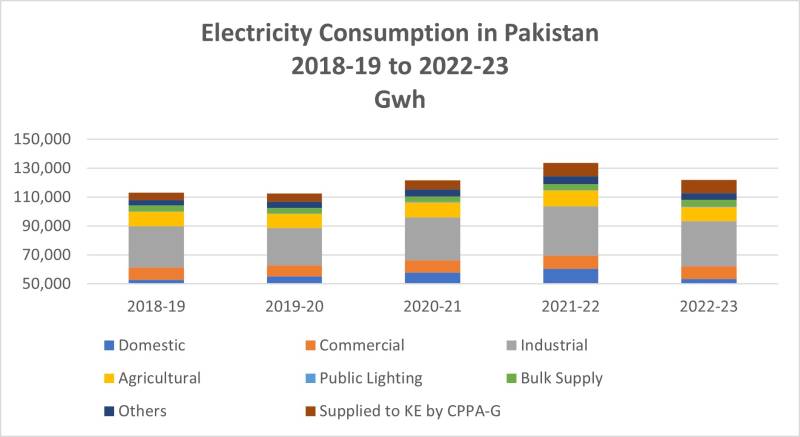

Even this estimate may turn out to be optimistic given the recent consumption trend and around 3-4% GDP growth expected in the next few years. Electricity consumption grew at an annual average of 1.87% from 2019-2023.

On the other hand, people continue to suffer from load shedding. On May 30, 2024, the federal energy minister, Awais Leghari, stated in a press conference that the government did not provide electricity to the high-loss feeders because doing so would have increased the circular debt due to financial losses. The federal minister admitted that load shedding occurred even on feeders where losses were lower than 20%, due to technical faults. Earlier, in April 2024, the minister acknowledged that distribution companies were guilty of overbilling consumers by billions of rupees to cover losses from power theft and non-recovery of dues. How did Pakistan end up in this situation where, despite having surplus generation capacity, it resorts to power cuts to mitigate financial losses from transmission and distribution inefficiencies?

In June 2013, I wrote in an article published by Dawn that Pakistan’s energy crisis, if not tackled at both operating and strategic levels in the immediate future, might become a national security threat.

Here is a quote from the June 2013 article: “the 1994 policy was against the very spirit of free market economics as the private sector was guaranteed a rate of return for putting in a rather small portion of its own equity while major risks were assumed by the government and 70-75 per cent of the investments were actually financed by the bank loans. The first big step in this direction was the Hub Power Project (or Hubco), a 1,292MW, $1.6-billion thermal project that was actively supported by the World Bank. It was the beginning of a strategic blunder that was to haunt Pakistan decades later.”

I wrote again on Pakistan’s energy policy and the IPPs in the Financial Times on 18 August 2018. Here is a quote from that article: “Pakistan approved 21 power projects at an expected total cost of $35 billion and most of them to be coal-fired. Not all of this “investment” is in the form of equity. The debt to equity ratio for many of the projects is 75% debt and 25% equity, with the return on invested equity reported to be as high as 34.5%.

The most harmful consequence of Pakistan’s approach has been to encourage rent-seeking. Business groups that already benefit from favourable tax exemptions or subsidies have jumped on the CPEC bandwagon as a way of making easy money.”

“When profit is guaranteed by the government, it is misleading to talk about “private investment.” This is the case with all the CPEC power projects, since the government is obliged to pay an agreed return regardless of whether the projects actually make money. Pakistan’s official external debt of $95 billion (30% of GDP) does not include this quasi-government debt.

The strategy of building infrastructure through projects that carry government-guaranteed profits, and which are financed largely through foreign currency debt, has now fallen apart.

In this context, it is worth noting that Malaysia’s prime minister Mahathir Mohamad has recently suspended $23bn in Chinese-backed projects and is seeking to renegotiate the terms of others.

The most harmful consequence of Pakistan’s approach has been to encourage rent-seeking. Business groups that already benefit from favourable tax exemptions or subsidies have jumped on the CPEC bandwagon as a way of making easy money.”

The World Bank’s Role and International Context

In the 1990s, the World Bank started pushing for the liberalisation of energy markets promoting the belief that governments had no job running this business to convince many countries to hand over the job of electricity production and distribution to private companies.

Many Asian countries, including South Korea, Malaysia, Indonesia, Vietnam, and Singapore did not follow the World Bank recommendations. The electricity sector in these countries continues to be dominated by the public sector although some (e.g. Thailand, Vietnam) allowed the IPPs to generate power but retained control over pricing.

IPP Experiment Called A Nightmare For Developing Countries

According to a report of the TRT World, thirty years since this trend began, the IPP experiment has turned into a nightmare of inflated and seemingly insurmountable bills for millions of people in developing and low-income countries, including Bangladesh, Ghana, The Gambia, Indonesia, Kenya, Nigeria, Pakistan, the Philippines, Rwanda, Tanzania and Zambia.

Earlier in 2024, the decision of Sheikh Hasina’s government In Bangladesh to buy electricity from Indian billionaire Gautam Adani’s imported coal power plant came under heavy criticism for paying significantly higher prices – in comparison to what it pays for its other coal-based power – under purchase power agreement.

Ghana has been trying to restructure $1.6 billion in arrears owed to the IPPs that account for 61% of the African country’s peak demand. Debt-ridden Ghana has struggled to make payments to foreign IPPs. One foreign IPP owner turned out to be a wanted person by Norwegian police in connection with the largest bank fraud in the Nordic country’s history.

“Politicians can make 10%, 20% on contracts with IPPs. They won’t be able to do that with a public sector electricity utility,” says Barnaby Joseph Dye, a lecturer at the University of York, who researches infrastructure projects in the Global South.

Pakistan’s Experience

According to Dr. Kamal Munir, pro-vice chancellor of Cambridge University, no sector of the economy is more important (at this juncture) than power generation and distribution. The price of electricity feeds into everything, and the escalating cost is crippling Pakistan’s industry.

Dr. Munir believes that if the government is serious about fixing the energy sector and reversing the rot that has set in, it needs to demolish the biggest myth the governments have been peddling. This myth suggests that the energy crisis is essentially a product of user subsidies, stealing of electricity and distribution losses.

“The World Bank, IMF and many advisers to the government have been at the forefront of creating this myth. The reality is that rather than users, it is the producers who are being generously subsidised and that is where the government will have to intervene if they wish to ever reverse the rot,” wrote Dr. Munir in a powerful article for Dawn in 2019. “Only 20-25% of the plant cost is contributed by the investors with the balance raised in debt which is repaid/guaranteed by the government. This is a textbook example of rent-seeking,” he added.

Some Special Cases

Kot Adhu Power Limited (KAPCO) produced zero electricity in FY 2023-24 but was paid Rs22.17 billion as capacity charges. Kot Addu Power Plant was built by the Pakistan Water and Power Development Authority (“WAPDA”) in five phases between 1985 and 1996. It was partly privatised in 1996 and its control has changed hands since then but it is mystifying why it is being paid capacity charges.

Another power plant, HUBCO (controlled by a local group) has remained largely idle but had to be paid capacity charge amounting to Rs 24 billion due to an award under the Arbitration Act 1940.

These plants were built before the CPEC projects were started in 2013.

Port Qasim Power Project.

Port Qasim Power Project comprises two 660 MW imported coal power plants. It reportedly operated at only 18% capacity during 2023-24, but received the second-highest capacity payment of Rs121.8 billion. This implied a total tariff of Rs177.56 per KWH, compared to the tariff of Rs76.27 of Sahiwal Coal Plant.

The generation licence (granted on 13 August 2014) is held by Port Qasim Electric Power Company (Private) Limited which is owned by Port Qasim Energy (Dubai) Holding Limited.

Port Qasim Energy (Dubai) Holding, a Dubai company, was incorporated on 7 July 2014 and is jointly owned by Qatar's Al-Mirqab Capital and Port Qasim Energy (Hong Kong) Holding Limited. Port Qasim Energy (Dubai) Holding Limited directors are the following as per a public register: Saifur Rehman Khan (former NAB chief under the PML-N government), Shahzad Shahbaz (Al Mirqab), Sheng Yuming (Power China), Zhong Haixiang and Fady Bakhos (Al Mirqab).

Majority of the Capacity Payments Relate to Public Sector Power Plants and Local Groups

The lobby representing the interests of the IPPs has indulged in a bit of fear-mongering, warning that attempts to renegotiate power purchase agreements (PPAs) could jeopardise future foreign investments. The hyperbole must be separated from facts. According to NEPRA's State of Industry Report 2023, a staggering amount of Rs 6,056 billion (or approximately $27 billion) was paid in capacity payments to the IPPs from FY2019-20 to FY2023-24 as shown in the chart.

During the FY 2023-24, the government made capacity payments of around Rs 2.1 trillion to the IPPs. This staggering amount represented about 1.9% of Pakistan’s GDP.

The chart shows the growth pattern:

45% of the capacity payments in 2023-24 were made to the government-owned plants, 15% to the private parties (mostly local) and 40% to the Chinese IPPs. Even the Chinese IPPs have local parties as equity investors and many are owned by Chinese state enterprises. They are not typical foreign private investors. The old contracts were renegotiated in 2020, so it is mostly about the foreign contracts negotiated since 2013 and the public sector plants.

Most of these PPAs were for 30 years and were front-loaded. That is, the pricing mechanism was so designed that the debt would be repaid in the first ten years and with a payback period of 3-4 years for the sponsors and even less if there were loopholes in project costing and the billing of imported materials.

The 17 power plants and six nuclear power plants in the following table accounted for Rs.1542 billion or nearly 3/4th of the total capacity payments of Rs2,100 billion in 2023-24.

Table of Largest Capacity Payments

The table lists the companies in order of the amount of capacity payments made, starting from the largest. The companies using imported coal were the most expensive in terms of unit cost, as seen from the table. The load factor of the three companies using imported coal was also less than 25% but they were paid Rs381bn (or 18%) out of the total capacity payments of Rs 2.1 trillion. The public sector hydel and RLNG plants were the most cost-effective as were the nuclear plants.

The total cost of generation for these plants was Rs 2,438 billion and the capacity payments accounted for nearly 63% of the total cost.

The capacity payments have risen sharply due to the devaluation of the rupee and higher interest rates. Through the PPAs, the government effectively guarantees the repayment of debt and assumes both interest rate and currency risks. As such these power plant investments are more like government bonds than equity investments. Worse, the terms were highly unfavourable for the country as the concerned government ministers and officials didn’t seem to know what they were signing for.

Former prime minister Shahid Khaqan Abbasi admitted, on a TV channel program in May 2024, that the IPP contracts should have been awarded through a bidding process and NEPRA did not know how to design such complex contracts.

The Energy Crisis is Part of the Overall Debt Crisis

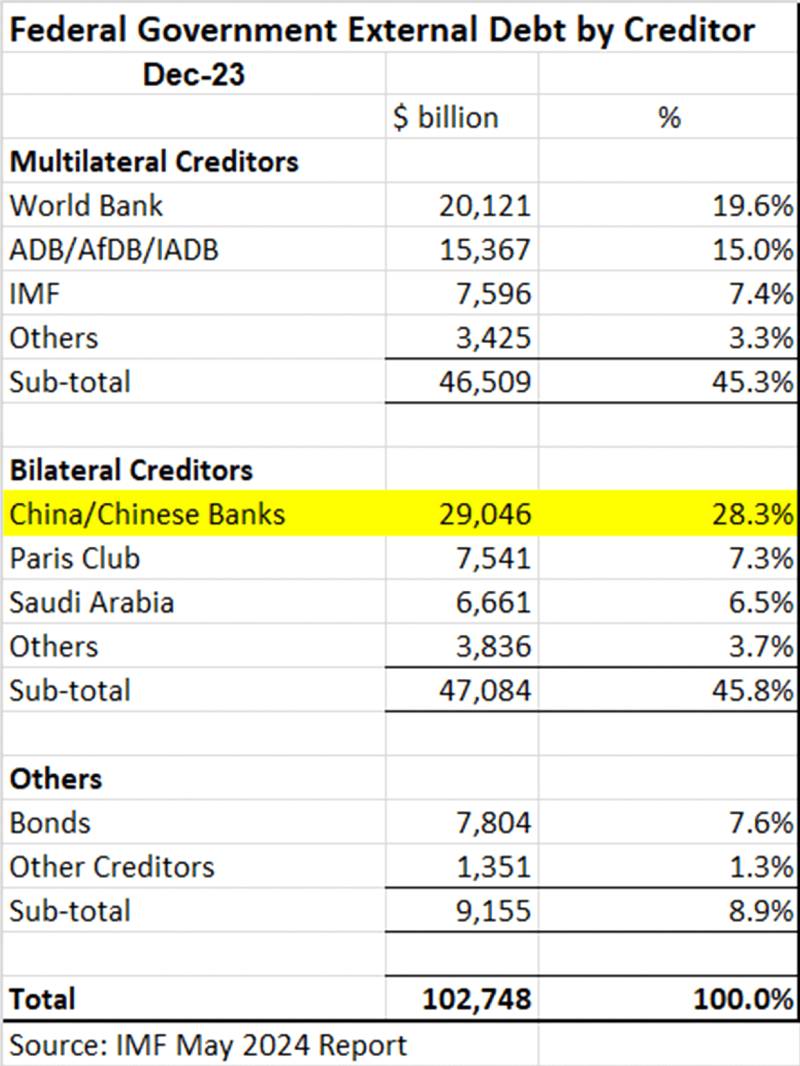

China is Pakistan's single largest creditor. About 28% of Pakistan's official external debt is owed to China.

The Chinese loans are more expensive and have shorter tenors compared to the loans extended by multilateral institutions such as the World Bank.

The Chinese investors in the IPPs must also be paid capacity payments in foreign currency. The Return on Equity (ROE) on these IPPs was very high. E.g. Huaneng Shandong Rui Group (Sahiwal project) 27%, China Power Hub Generation Company (Private) Limited 27.2%, Engro Power Gen Thar Ltd. / China Machinery Engineering Corporation (CMEC) 30.65%, and Shanghai Electric Power Company Limited (Thar Coal I project) 34.49%.

The combination of commercial loans and high guaranteed return on equity on these power projects has exacerbated Pakistan's balance of payments situation in addition to contributing toward high energy costs and build-up of the circular debt.

Pakistan Pleading With China to Help With Energy Debt

According to media reports, Pakistan has sought an 8-year extension on the repayment period for loans related to both China-Pakistan Economic Corridor (CPEC) and non-CPEC Chinese-funded projects. The total loans for CPEC and nuclear power plant projects amount to around $17 billion. Pakistan is negotiating with China to not only extend the loan repayment period but also reduce the interest rate on these loans and convert US dollar-based interest payments to Chinese currency. It should be noted that some of the Chinese companies involved in the power sector in Pakistan are state-owned and not private investors as has been wrongly reported by a section of the media.

What About the Public Sector Plants?

While the government’s belated initiative to seek relief from China is in the right direction, it remains a fact that 45 per cent of the capacity payments relate to the public sector (federal government and Punjab government).

We need to separate the debt issue from the electricity pricing. The debt issue is part of Pakistan’s debt problem and fiscal management and should be tackled through a combination of reprofiling/restructuring of the domestic debt and expenditure cuts. The prices should be market driven but Pakistan’s single buyer model means there is no competitive electricity market in Pakistan and the pricing is non-transparent and shrouded in secretive deals between the government and the rent-seekers.

India has allowed the IPPs to operate for many years but it follows a decentralised system and allows the state governments to make purchase power agreements independently under the overall framework of its federal regulations, administered by the Central Electricity Regulatory Commission, which cap the return at 15.5 per cent in local currency terms.

Is Privatisation of the Power Distribution The Ultimate Solution?

The energy crisis cannot be taken lightly nor can it be resolved through TV debates, newspaper columns, or cabinet meetings.

South Korea, Indonesia, Malaysia, and Singapore opted not to go for wholesale privatisation of electricity generation and distribution because of the following three key policy considerations: (1) Macroeconomic resilience and energy security, (2) Social equitability and affordability, and (3) Ensuring environmental sustainability.

There are about a dozen DISCOs in Pakistan. According to the federal energy minister, there were about Rs1.9 trillion worth of bills currently outstanding and the circular debt stood at about Rs2.5tr. Then there is the issue of transmission and distribution (T&D) losses. The T&D losses of the DISCOs are due to a variety of reasons including low-voltage transmission and distribution lines, weak grid infrastructure, inaccurate metering and billing, and outright theft. During 2016-17, T&D losses were reported at 18% of the gross purchases made by the DISCOs. During FY 2022-23, the T&D losses amounted to 16.45% and contributed to an increase of Rs160.5 billion in the circular debt. Given the state of the current transmission network, it could require an investment of $400-500 million annually for the next few years.

It is naive to believe that Discos can be easily privatised or it would resolve the issues. There are no qualified investors around. Local brokers, textile spinning or sugar mill owners have neither the billions nor the management teams and expertise, required to run such businesses.

Privatisation of Electricity transmission and distribution requires companies with both the expertise and deep pockets to invest. Often, economies of scale dictate these companies are large and of sufficient size to be able to raise capital from both private and public markets. It has become a standard thing to say, privatise Discos. It is not that simple. People should study and learn about the experiences, failures and successes of other developing countries. India is not exactly an example of success in this respect. East Asian countries have done a lot better.

Conclusion

The energy sector remains mired in controversy. In Pakistan’s case, it has contributed significantly to worsening the country’s debt crisis, and it has affected millions of people. This is a crisis that lies at the heart of Pakistan’s economic and debt problems. It is also critical to poverty reduction, economic revival, and social development.

As an interim relief measure, the government should not charge any tax on the electricity bills. The government collected about Rs. 630 billion as taxes on electricity bills in 2023 and this amount could be around Rs 700 billion for the current financial year. The total size of the public sector development program (PSDP) is Rs 1400 billion and the total current expenditure for defence, pensions, and running of the federal government is around Rs 4.1 trillion as follows:

| Rs. Billions | 2023-24 | 2024-25 | % Increase |

| Defence | 1,804 | 2,144 | 18.8% |

| Pensions | 801 | 1,114 | 39.1% |

| Running civil government | 714 | 839 | 17.5% |

| Total | 3,319 | 4,097 | 23.4% |

The PSDP and the above federal government expenditures combined amount to Rs. 5.5 tr. A reduction of Rs 700 billion to eliminate tax collection through electricity bills could reduce the electricity bills by about 20% for the final consumers and would represent a cut of 12.7% in the total current and development expenditure of the federal government of Rs 5.5 tr. It should be possible if the people at the helm understand the gravity of the crisis that is fuelling social unrest and causing tremendous economic hardship.

Beyond this temporary relief measure, the energy policy must not be approached in a haphazard and ad-hoc manner with a transactional approach. That path can lead to even bigger crises as Pakistan is learning the hard way.

The government does not have a single energy economist in a senior position. Chinese corporations have built power plans and even motorways.

There is no escaping from turning to independent energy economists and financial experts with subject expertise and international experience and seeking their help by forming a high-powered energy and debt task force to (a) prepare a report on the existing situation, and (b) submit recommendations to implement a program of debt and energy reforms. This process must be completely transparent and all facts and recommendations must be disclosed to the public before implementation.

The way forward lies in learning the lessons of the last 25 years. The solution lies in public ownership (preferably through companies listed on the stock exchanges) with management expertise drawn from the private sector, as we have seen in South Korea, Singapore, and several other countries. It will not be easy as the political and economic elite has been the biggest beneficiary of the status quo. It will be a tough battle. But then it is worth remembering that no battle is tougher than that of the ordinary citizens of Pakistan who have lived through the nightmare created by the energy policies pursued over the last two and a half decades.