The Pakistani rupee plummeted to a new low of 269.63 against the dollar on 30th January. Earlier, the interbank rate of the rupee saw a historic fall as the opening rate of the dollar in the interbank market on 26th January fell sharply from PKR 230.89 to PKR 255.43, resulting in a single day rupee depreciation of around 10%. Hence, this translated into the most rapid fall in rupee’s value for over two decades.

Therefore, this prompted the government to increase fuel prices and Finance Minister Ishaq Dar, on Sunday, announced a price hike of Rs 35 for petrol and diesel.

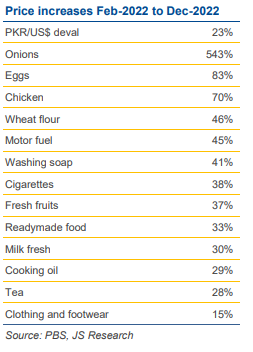

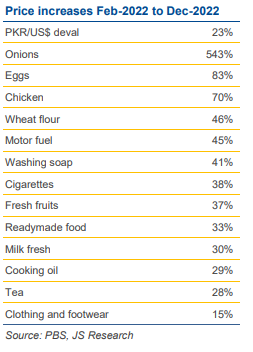

Due to the bulk adjustment in currency and the subsequent fuel price hikes, experts are anticipating the inflation figures to breach the 30 percent barrier. This key drivers for the new wave of inflation would be commodities like fuel, edible oil and items for which Pakistan is a net importer.

“First, assuming most PKR adjustment against US$ has materialized, we expect a higher MoM CPI for the coming months, followed by softer MoM readings in subsequent months. The same would also then increase the base for 3QFY24’s CPI, reducing CPI pace for FY24. This would mean higher CPI levels from current base case in immediate months, and reversion to earlier forecasts beyond that,” read a report by JS Global.

“First, assuming most PKR adjustment against US$ has materialized, we expect a higher MoM CPI for the coming months, followed by softer MoM readings in subsequent months. The same would also then increase the base for 3QFY24’s CPI, reducing CPI pace for FY24. This would mean higher CPI levels from current base case in immediate months, and reversion to earlier forecasts beyond that,” read a report by JS Global.

“The second scenario would be further PKR devaluation from here. In this scenario, CPI levels may witness a parallel upward shift from current base case estimates. In any scenario, 30%+ CPI months now seem inevitable. This would further create pressure on monetary stance, which has been on a tightening mode for over a year to anchor inflation. Moreover, as IMF stresses upon importance of tightening policy to reduce inflation and for central bank to be proactive as the situation unfolds, the prospective 1300bp+ negative real interest rates will require regulators attention,” the report further added.

Additionally, higher transport costs are going to affect consumers directly through hike in fares and indirectly through an increase in commodity prices specially food, beverages and consumer durables that have a significant transport cost component in their final prices.

Therefore, this prompted the government to increase fuel prices and Finance Minister Ishaq Dar, on Sunday, announced a price hike of Rs 35 for petrol and diesel.

Due to the bulk adjustment in currency and the subsequent fuel price hikes, experts are anticipating the inflation figures to breach the 30 percent barrier. This key drivers for the new wave of inflation would be commodities like fuel, edible oil and items for which Pakistan is a net importer.

“First, assuming most PKR adjustment against US$ has materialized, we expect a higher MoM CPI for the coming months, followed by softer MoM readings in subsequent months. The same would also then increase the base for 3QFY24’s CPI, reducing CPI pace for FY24. This would mean higher CPI levels from current base case in immediate months, and reversion to earlier forecasts beyond that,” read a report by JS Global.

“First, assuming most PKR adjustment against US$ has materialized, we expect a higher MoM CPI for the coming months, followed by softer MoM readings in subsequent months. The same would also then increase the base for 3QFY24’s CPI, reducing CPI pace for FY24. This would mean higher CPI levels from current base case in immediate months, and reversion to earlier forecasts beyond that,” read a report by JS Global.“The second scenario would be further PKR devaluation from here. In this scenario, CPI levels may witness a parallel upward shift from current base case estimates. In any scenario, 30%+ CPI months now seem inevitable. This would further create pressure on monetary stance, which has been on a tightening mode for over a year to anchor inflation. Moreover, as IMF stresses upon importance of tightening policy to reduce inflation and for central bank to be proactive as the situation unfolds, the prospective 1300bp+ negative real interest rates will require regulators attention,” the report further added.

Additionally, higher transport costs are going to affect consumers directly through hike in fares and indirectly through an increase in commodity prices specially food, beverages and consumer durables that have a significant transport cost component in their final prices.