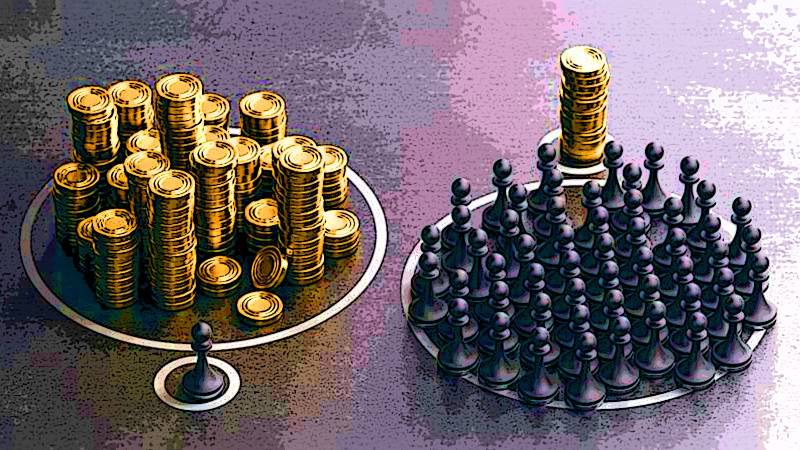

Unequal distribution of wealth, indifference to the ordinary, concentration of political power in the hands of dynastic families, generation of wealth, and subsequent upward social mobility for the elites are some of colonialism's characteristics.

Pakistan, which broke away from the British colonial rule in 1947, has an economic framework that continues to facilitate and feed powerful individuals and entities, leaving the underprivileged sections of society to fend for themselves. Elite capture, a remnant of British Imperialism, devours the national economy, ultimately undermining social protection programmes. While our dear country is teetering on multiple economic crises, institutional capture continues unabated.

An inquiry conducted by the Competition Commission of Pakistan (CCP) reportedly revealed that the fertiliser sector secured a gas subsidy worth a whopping Rs152 billion but never passed the benefits on to the consumers. The profits of the fertiliser sector giants run into billions of rupees, which clearly indicates that they have gone up at the cost of voiceless consumers.

The report is said to have traced price adjustments, both increases and decreases, and found that they were made simultaneously by all companies, indicating a coordinated pricing strategy. Such murky methods applied by the entities in question have not been unearthed for the first time. Nor will it be the last. Since both powerful individuals and institutions own such profiteering companies, the axe of accountability has never fallen on those companies involved in monkey business. Nor will the same fall on them in the foreseeable future. Jonathan Swift rightly remarked, "Laws are like cobwebs, which may catch small flies but let wasps and hornets break through."

Who cares for the voiceless consumers?

Agriculture is the country's backbone, and farmers can be called the spinal cord sustaining the body politic. Despite this, cruel capitalism has historically created a combination, on the one hand, hoarding, black marketing and consequent inflated prices of chemical fertilisers during the seeding and planting season, on the other, denying fair prices to the farmers for agricultural crops. Let us not forget that wheat, sugar cane, cotton growers, etc., are not offered appropriate prices in the open market. As a result, the farmers growing these crops are compelled to sell their produce at low prices in the open market following the failure of the government's procurement and pricing policies.

The provincial governments of Punjab, Sindh and Balochistan have fixed the price of wheat at Rs4,000 per maund (40kg). Despite this, wheat prices have plummeted, prompting the farmers to sell their wheat at prices ranging from Rs3,000 to Rs3,200 per maund. Consequently, farmers are bearing a loss of Rs700 to Rs900.

Investment in the wheat crop was higher this season because of both inflated rates and black-marketing of chemical fertilisers and pesticides and cultivation expenses in the face of price hikes in petrol and diesel that lubricate agricultural machinery

Not only this, but Mother Nature has dashed the dreams of getting a better price for those farmers who had delayed their harvest as climate change-induced rains and winds ruined the standing wheat crops.

A report by the Auditor General of Pakistan dropped a bombshell on the government agencies—the Trading Corporation of Pakistan (TCP) and Passco—having concluded that the two entities in question caused a loss of $31.32 million to the national exchequer owing to the import of wheat at inflated rates from 2017 to 2022.

Consequently, the price of flour increased in the country, burdening consumers. Moreover, last July, the federal government decided to import wheat. Impartial experts have questioned the logic behind greenlighting wheat imports at a time when the harvest season was under way, and it subsequently led to prices crashing by 40%, thus causing the economic murder of farmers.

On the heels of the wheat import scandal and consequent plummeting prices, wheat protests spawned across the country, with farmers demanding a fair price. Neither heads will roll, nor will the protesters get heard. It goes without saying that investment in the wheat crop was higher this season because of both inflated rates and black-marketing of chemical fertilisers and pesticides and cultivation expenses in the face of price hikes in petrol and diesel that lubricate agricultural machinery. The government's procurement policy is tilted to the landed aristocracy.

While small-scale farmers run pillar to post for gunny bags, the business tycoons and feudal lords end up with the stock. The former receives the bags allegedly by greasing the palms of food department officials, and the latter gets the same thanks to political connection or influence. The government's inability to implement the wheat support price and discriminatory policy of distributing gunny bags, ultimately denying ordinary farmers, suggests a network of disadvantages at play, undermining their agricultural prosperity.

Moreover, a corporate farming experiment spread across 4.4 acres of land, called the Green Pakistan Initiative, is being touted as a panacea to our economic ills. One is afraid that this will prove to be another link in the chain called elite capture. The production of this initiative in question will have a monopoly in every context. No rocket science is required to figure out that the beneficiaries of this project will also be the same powerful folks.

According to the Pakistan National Human Development Report 2020, released by the United Nations Development Programme (UNDP), the total privileges enjoyed by Pakistan's most popular groups, including the feudal class, the corporate sector, exporters, large-scale traders, high-net-worth individuals, the military establishment -and state-owned enterprises, were documented at Rs2,660 billion in 2017-18, or around 7% of the country's Gross Domestic Product (GDP), these privileges can be broken down into favourable pricing, lower taxation and preferential access. The report's lead author, Dr Hafeez Pasha, believed that the corresponding cost of social protection programmes (2019) was Rs624 billion. Diverting just 24% of these privileges to the poor could double their benefits. Redistribution along these lines is a crucial first step to alleviating inequality. The same report placed the blame of institutional failure at the doors of regulatory structures, having concluded: "Poor regulation by the National Electric Power Regulatory Authority (NEPRA) and the Oil and Gas Regulatory Authority (OGRA) increases the cost burden on end consumers and hinders socio-economic development. The State Bank of Pakistan has been unable to control the build-up of a credit monopoly in the financial sector. As a result, low-income individuals are denied access to credit.

The Securities and Exchange Commission of Pakistan (SECP) has been unable to perform its core function of creating confidence in the stock market and raising enough capital for new listings. The Competition Commission of Pakistan (CCP), too, was found to be inactive in ensuring competitive pricing and fair trade practices.

The report speaks of major regulatory failures to crack down on monopolies and cartels in the country. In fact, from 2007 to 2018, the National Human Development Report (NHDR) 2020 found that an average of six industries per year are either potential cartels or practice deceptive marketing. The most flagrant offenders singled out of these were from the cement, sugar, and automotive industries.

The successive ruling elites in Pakistan have rewritten the rules, establishing a manipulative economic system in contravention of Muhammad Ali Jinnah's ideals about Pakistan—a welfare state. And all of this is happening in a country plagued by multiple economic and financial crises and political instability. Yet, an environment is created by successive governments before they hammer out a bailout package with the International Monetary Fund (IMF) as if the crushed dreams of the youth would be realised on the back of the bailout package and social injustice would be replaced with the democratic distribution of national wealth.

In a recent talk, Columnist Khurram Husain claimed that such bailout packages are doled out to countries that are on the cusp of defaulting on their credit payments due to the debtors. Packages such as these are never meant to improve a worsening economy but underpin the country, ultimately enabling it to return due instalments of loans so that the global economic order can be saved from dire consequences caused by the default of any country trapped in debt and circular debt. Instead of scrapping the elite capture that has strangulated our national economy, the economic burden is passed on to the vast majority while taxes are slapped on their utility bills.

Middle and lower middle classes 'earn and spend' subsequently lubricating the engines of commercial markets. Once they become cash-strapped, the markets will be yawning for customers

See the taxes levied, fleecing terms invented, and sky-rocketing charges in gas bills received by the subscriber—a daily wager— that consumed only 72 units:

Breakup of the bill:

- Gas charges:Rs1,524

- Meter rent: Rs40

- Fixed charges: Rs1,000

- General Sales Tax Standard: Rs462

- Adjustment-debit: Rs289

The same subscriber's monthly bill from January 2023, with 77 units consumed, was Rs624. In 2024, the monthly bill for March, with 71 units consumed, was Rs3,310, a 400-fold increase.

A victim of this bad economic model rightly asked: "Has the government rolled back its long-etablished utility patronage, i.e., free utility and subsidised units of gas and electricity doled out to the privileged individuals and profiteering institutions? What is the difference between those snatching valuables from the public through street crimes at gunpoint and the one used in utility bills being discussed?"

The real rags-to-riches stories materialise for only 3% of the population, where three out of every 100 people will move from the bottom 20% of the economic spectrum to the top

Faced with a financial crunch, those who were issued inflated utility bills have demanded an explanation from those presiding over this exploitative economic arrangement. The rising cost of living and inflated utility bills have broken the back of the middle and lower middle classes.

Professor Abdul Majid Suleman believes that these two classes — which make up the bulk of the country's population — are fast losing their purchasing power, which will negatively impact commercial activity in the country. He concluded that the middle and lower middle classes 'earn and spend' subsequently lubricating the engines of commercial markets. Once they become cash-strapped, the markets will be yawning for customers. The logic offered is convincing since the super-rich and ruling elites either invest their money in long-term commercial projects or park their money in tax havens abroad. Those with deep pockets in the middle class are left with no option but to invest their money in real estate businesses.

Establishing small industrial units at the district level is not an option given the deteriorating law and order situation and the lack of ease of doing business for those with no elite foundation to establish an industrial edifice.

As a result, we see the commercialisation of farmland. If this issue continues to go unchecked, we may face food insecurity in the decades to come. Make no mistake: There is no mechanism slated so far to diffuse the population bomb. Some other countries are opting for farming land in foreign capitals to sustain growing food demand at home.

Some countries have visionary leadership; unfortunately, our dear country is infested with short-sighted economic policymakers, authoritarian populists, and prisoners of family politics.

Recently, the media was abuzz with the idea that the government was considering fixed taxes for residential and commercial consumers after seeing a spike in people — fed up with long hours of load-shedding and overbilling — switching over to solarisation. Social media campaigns asking questions about the proposed tax were launched: Is the sun the government's property? What kind of extra service is the state providing solarisation when consumers are paying sales tax? The incumbent government, however, denied it was mulling over such a tax. However, retaining money-extracting schemes such as fixed charges in gas bills starting from Rs400, Rs1,000, Rs2,000 and onwards for different consumption slabs will likely create unprecedented public indignation.

It is not all doom and gloom, however. Pakistanis continue to experience social upward mobility, but it is limited to the old established elites and the newly rich. A study conducted by the Pakistan Institute of Development and Economics (2012) found a 72% chance that the son of a man who works in an elementary/basic occupation will hold a similar role. Of the families at the bottom of Pakistan's income ladder, 44% will experience no mobility at all, and the vast majority of the remaining 56% who experience some upward economic mobility will not be able to move by more than 20% to the next quintile.

The real rags-to-riches stories materialise for only 3% of the population, where three out of every 100 people will move from the bottom 20% of the economic spectrum to the top throughout their lifetime.

The lack of equal employment opportunities is the driving force behind the brain drain, as both educated and skilled youth are leaving the country to get a better salary and a decent and secure life in foreign countries.