The economic spiral of Pakistan, one of China's largest country-level loan portfolios, has worsened to such a level in recent years that Beijing has been forced to shift financing from the 'game-changing' multi billion-dollar China-Pakistan Economic Corridor (CPEC) development scheme to emergency loan financing aimed at keeping the Pakistani economy afloat lest it drag Chinese banks with it into the economy abyss of default.

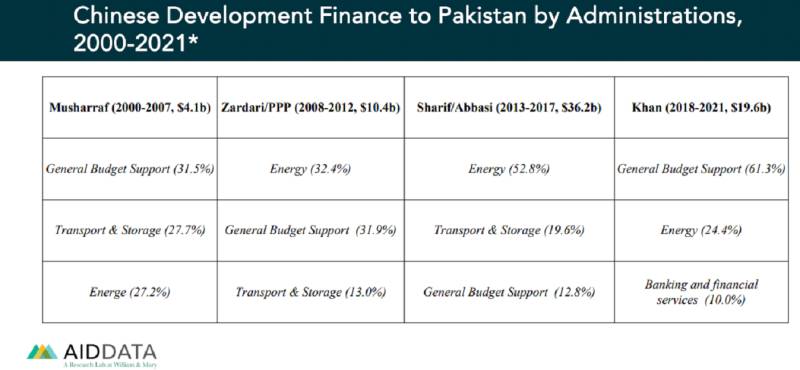

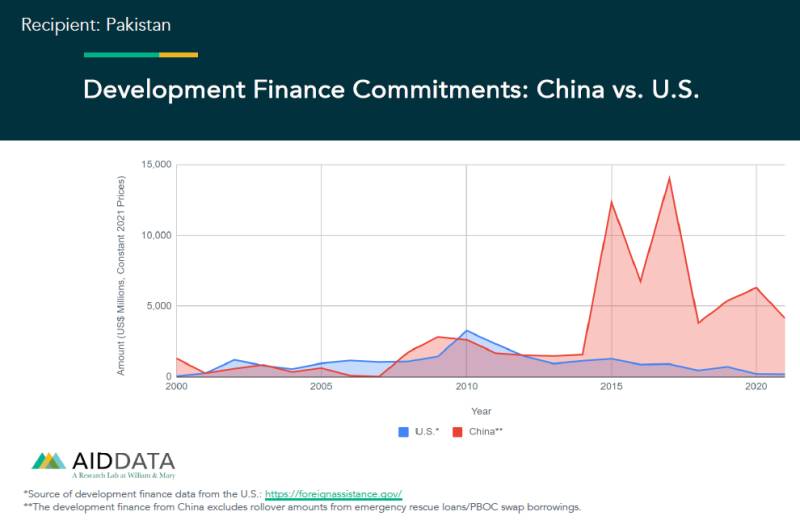

A recent report and data published by AidData, “Belt and Road Reboot: Beijing's Bid to De-Risk Its Global Infrastructure Initiative”, highlights key trends that have shaped Chinese Development Financing over the past two decades. Collected from over 5,300 sources, it shows that China, the largest lender to the developing world, has transitioned from development financing to rescue lending. This transition aims to enable its largest sovereign borrowers to have enough cash on hand to service their outstanding infrastructure project debts owed to Chinese commercial banks. By doing so, China aims to avoid a domestic banking and financial crisis caused by high default rates. Central to this scenario is Pakistan, which has received 161 loans over the past decade and a half worth some $68.92 billion. Pakistan is the third largest recipient of Chinese money, behind Russia and Venezuela.

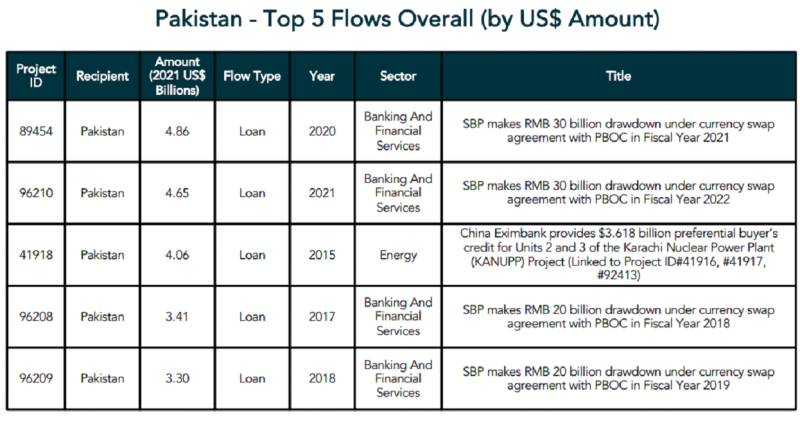

The worrying aspect of this, for both Pakistan and China, is that rescue lending originating from China to Pakistan stands at a whopping $28.13 billion, making it the highest in the world, followed by Argentina, Ecuador, and Venezuela. It also comprises Pakistan's single largest debt source.

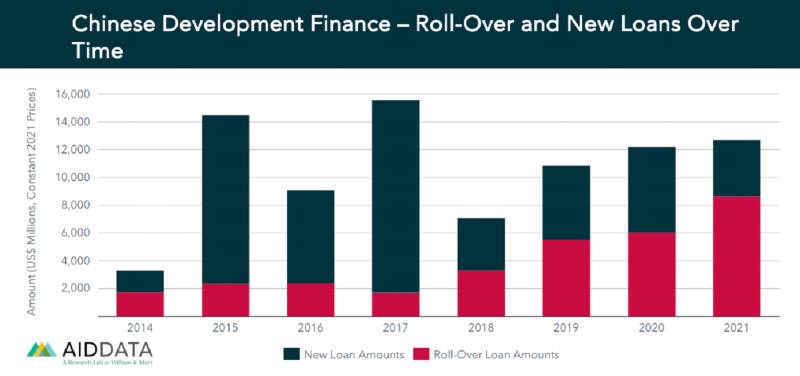

AidData suggests that starting in 2017, a significant portion of Chinese development finance to Pakistan was directed towards rescue loans to pull Pakistan's economy back from the brink rather than putting them towards developmental projects. This represents a shift from the previous emphasis on the China-Pakistan Economic Corridor (CPEC) during its peak period from 2014 to 2017, when substantial commitments were made for developmental initiatives.

Over the past four years, rollovers of Chinese loans have become increasingly common, often surpassing or matching the value of new loan commitments. However, AidData shows that Chinese lending in Pakistan has primarily targeted public sector agencies, indicating a low probability of any hidden debts.

De-Risking Lending

The report provides further details on China's approach towards overseas lending in general. China proactively manages potential crises by implementing de-risking measures. This includes a reduction in long-term, dollar-denominated bilateral loans for public investments, coupled with an increase in Chinese Yuan (RMB) denominated loans of shorter durations involving both Chinese and non-Chinese banks. China is also reducing its reliance on policy banks while relying more on state-owned commercial banks, along with syndicated loan arrangements that allow non-Chinese institutions with stronger due diligence practices to assess potential borrowers.

An intriguing point emphasised in the report revolves around China's role in managing global crises. Developing countries burdened with debt distress owe a significant portion of their debt to China. This situation exposes Chinese state-owned policy banks, commercial banks, and enterprises to the risk of default from overseas borrowers.

To ensure liquidity for these borrowers to repay their debts to Chinese creditors, the People's Bank of China (PBOC) is extending emergency rescue loans, including those in Chinese currency like Currency Swaps (See below).

Currency Swap Agreements

A bilateral currency swap agreement, also known as a central bank liquidity swap agreement, allows two countries' central banks to exchange cash flows in different currencies at predetermined rates for a specific period. This arrangement facilitates trade settlements using national currencies, helps manage local bank demands, and provides liquidity support to financial markets. In this process, one party becomes the borrower and the other becomes the lender, with fixed or floating interest payments made by the borrower on the principal amount. If both parties draw down on the swap line, they exchange interest payments on their respective principals.

Now let's break down the 5-step process of using a currency swap line with the People's Bank of China (PBOC) from the perspective of an importer, which we'll assume is Pakistan, seeking to settle trade with a Chinese firm using the Chinese currency, the RMB:

Step 1: The central bank of Pakistan and the PBOC activate their currency swap agreement by depositing a specific amount of their own currency into an account controlled by the other party.

Step 2: An importer in Pakistan applies for an RMB loan from a domestic bank.

Step 3: The domestic bank in Pakistan applies to the central bank for the RMB loan. Once approved, the central bank asks the PBOC to transfer the RMB funds from the account held with them to the loan applicant's account with a corresponding bank in China.

Step 4: The domestic bank instructs the corresponding bank in China to transfer the RMB funds to the Chinese exporter's account, allowing the exporter to receive the RMB funds.

Step 5: The importer in Pakistan repays the RMB loan when it matures. The domestic bank notifies the central bank of Pakistan about the repayment and transfers the RMB funds back to the central bank's account via the corresponding bank in China.

From an accounting perspective, the RMB deposit is recorded as an asset on Pakistan's central bank's balance sheet, while the corresponding liability represents China's claims in the central bank. The exchange of currencies is recorded as an increase in assets and liabilities of the monetary authorities in the balance of payments. This mechanism enables the PBOC to provide renminbi liquidity to other central banks, enhancing the speed, convenience, and volume of transactions between the countries.

Source: AidData

The intention behind this, as per the report, might be to promote the internationalisation of the RMB, enhance its usage in cross-border transactions, and lay the foundation for it to become a global reserve currency. Moreover, Chinese lenders show a willingness to postpone principal and interest payments for a few years, offering temporary relief for cash flow while exercising caution to minimise financial losses. These emergency rescue loans provided by China carry higher interest rates compared to the existing debt of the borrowers, and the loans have short maturities that are frequently extended.

Pakistan’s Conundrum

Pakistan’s case is quite similar. It is the largest recipient of Chinese rescue lending and has frequently opted for a loan rollover amidst the forex liquidity crisis.

Further, as per the report, the rising debt distress in the Global South has led to two groups of countries being more inclined to increase their RMB reserve holdings. The first group consists of countries facing liquidity and solvency problems who wish to avoid borrowing from the likes of the International Monetary Fund (IMF) due to concerns about policy conditionalities. The second group includes countries seeking IMF support but requiring additional aid to stay afloat, like Pakistan.

Regarding the second group, AidData’s findings suggest China's intentions are not clear, but recent events in Argentina offer some insight. In 2023, Argentina had dangerously low dollar reserves, quite like Pakistan, and urgently needed funding to avoid defaulting on its $44 billion loan agreement with the IMF. The PBOC came to the rescue by allowing Argentina to use RMB, obtained through a swap line, to make debt service payments to the IMF, thus preserving its dollar reserves. This highlights China's interest in preventing its largest borrowers with significant dollar debts from depleting their reserves.

Pakistan has also been the recipient of significant rescue lending from China, primarily in the form of swap agreements. The following figures, compiled by AidData, provide a clearer picture of the situation.

China undeniably played a significant role in keeping Pakistan’s economy afloat during the past year and a half. However, Pakistan continues to grapple with mounting debt burdens, including the high costs of servicing the debt. Recent discussions with the IMF have brought to light an additional budget gap resulting from the increased debt servicing costs.

Therefore, the country is in dire need of a resolution to its debt problem. However, any discussions concerning this matter would need to involve China.

Unfortunately, the findings of AidData do not indicate that China is willing to accept financial losses (haircut on its lending). On the contrary, Beijing seems to be becoming more determined and preparing for a prolonged and challenging situation. It is withdrawing funds from the escrow accounts of its overseas borrowers, demanding that borrowers replenish these accounts to receive short-term cash flow relief. Additionally, China is implementing stricter penalties for late repayments and providing emergency rescue loans with higher interest rates and short repayment periods to financially distressed borrowers.

This makes it challenging for countries like Pakistan to continue seeking any form of debt relief from its lenders, given that a preferential treatment of its neighbour wouldn’t sit well, especially with multilateral institutions such as the World Bank and the IMF.

Thus, the public in developing countries such as Pakistan is the most affected by this situation, as they continue to endure austerity measures resulting from the failure of foreign creditors to take collective action.