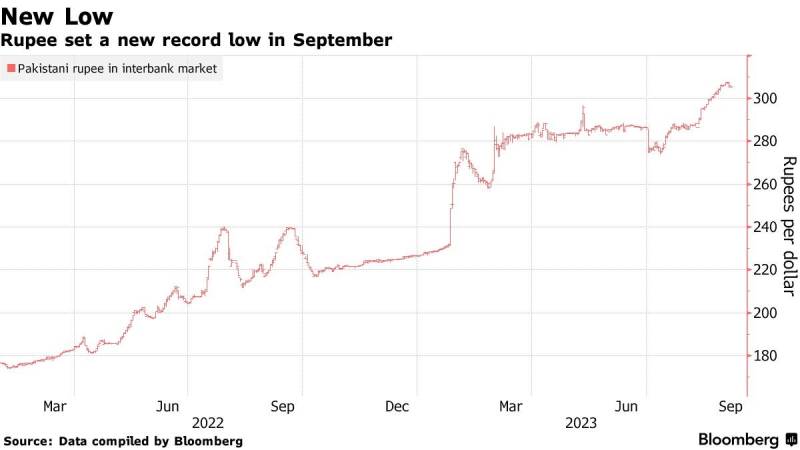

The open market rate of the dollar has been tamed, with it falling below Rs. 300 from a peak of over Rs. 330. The previous surge in the rate became a matter of concern for the government, as it had made an agreement with the International Monetary Fund (IMF) to keep the difference between the open market rate and the interbank rate below 1.25%. However, in the past few weeks, this difference had peaked at approximately 9%.

The surge in the open market rate occurred primarily due to parallel market transactions and hoarding, which led to the pressure on the interbank rate which, as mentioned earlier, is pegged against the open market. Further, the widening gap meant that dollar liquidity was redirected from banking channels to the grey market.

As a result, the authorities took decisive action, with both civilian and military agencies in Pakistan leading a nationwide crackdown on money exchange companies involved in unrecorded transactions of the dollar.

“The appreciation in the open market rate is a result of the reforms being implemented by regulators in the money exchange sector. As a result, the gap between the open market and intermarket rates has significantly reduced, going from a recent high of 9% to now almost reaching a negative value,” remarked Amreen Soorani, Head of Research at JS Capital.

Curbing the Rate

The interbank market, as the name suggests, serves as a platform for dollar trading between banks. Consequently, it is subject to stringent regulation, making any form of speculation quite challenging. Furthermore, even if speculation were to occur, it would be short-lived and swiftly curtailed by the State Bank of Pakistan (SBP).

On the other hand, the open market, served by the money exchange companies, functions as a retail outlet for the buying and selling of foreign exchange. The primary inflows in this market are through remittances, while the demand arises from individuals who are planning to travel abroad.

However, participants in this market have been involved in illicit dollar trading, mainly in two forms. Firstly, they engage in selling dollars to walk-in customers at a premium, while keeping these transactions off the books and not declaring them to the SBP. The intention behind this trade, for both parties involved, is purely speculative and driven by the desire to make quick profits.

The rate creates enough room in terms of margins for the exchange companies to buy the dollars from customers at a rate above the prevailing open market rate. When this purchase side transaction is recorded on the books, reported to the SBP, and replicated at scale across the country, it sends a signal to the market, pushing the exchange rate upwards.

Secondly, exchange companies are also involved in the smuggling of dollars to Afghanistan. It has been widely reported that Afghanistan heavily relies on Pakistan for its forex supplies. This results in sucking the dollar supply out of the market, leading to an increase in the exchange rate.

This situation, therefore, necessitated action from the regulator as the interbank market was feeling the heat and the government couldn’t afford to breach the agreement with the IMF.

In response to these activities, the Federal Investigation Agency (FIA) carried out a crackdown on money exchanges, arresting individuals involved in the illegal trade. Additionally, FIA personnel were deployed outside major exchanges to monitor transaction flows, creating a strong incentive for market players to cease unrecorded transactions. As a result, individuals began directing their forex receipts to the interbank market, leading to increased liquidity.

Furthermore, many money exchanges were made to surrender surplus dollars, likely stemming from unrecorded transactions, to banks. This further improved liquidity in the interbank market.

As per Yousuf Farooq, head of research at Chase Securities, “The convergence has mostly happened because of a crackdown on double books by exchange companies and smuggling. Devaluation overall will help exports and compress imports going forward. The convergence could lead to a reduction in the rate of rupee devaluation and soften inflation over the next few months. Yet, only an increase in exports and fiscal discipline can permanently solve the problem.”

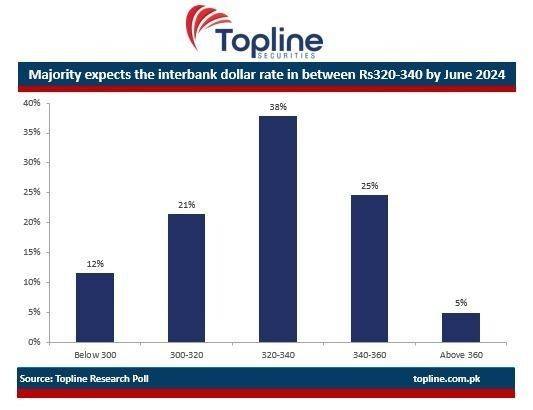

However, it remains to be seen that for how long the exchange rate can be effectively controlled through the use of force, considering that market sentiment towards the rupee is generally not very optimistic.

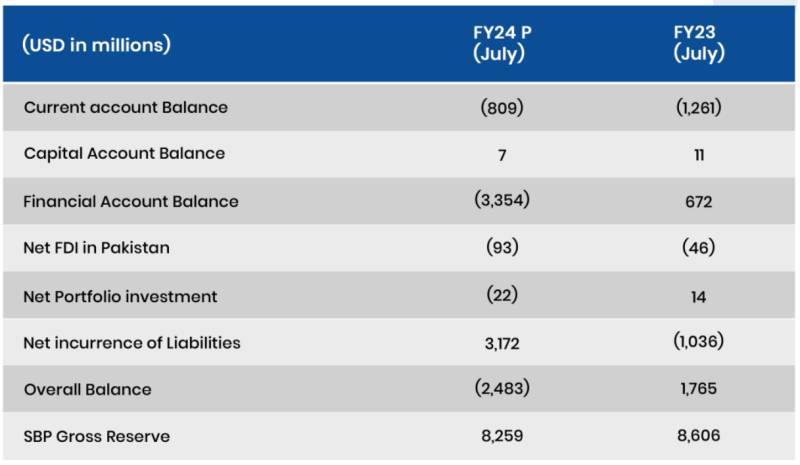

The sentiment is driven by the external account position, which continues to face pressure. Although imports have been reduced through administrative measures, this, combined with working capital and financing challenges for the local industry, has resulted in a decline in exports. Additionally, the flow of remittances has been volatile.

Source: Pakonomics July 2023

“In some ways, Pakistan is replaying the model of the 2013 counter-revolution and coup in Egypt, which brought then General Sisi to power and put the mass political awakening genie of the 'Arab Spring' back in the bottle. To expect very different results in the long term, albeit with bouts of optimism along the way with an IMF deal or a clearing-of-the-decks devaluation here and some supply-side liberalisation and privatisation deal there, might be wishful thinking,” writes economic analyst Hasnain Mailk.