The IMF’s Executive Board has given the green light for the first installment ($1.2 billion) of a nine-month Stand-By Arrangement (SBA) for Pakistan, totaling $3 billion. The initial tranche will be released in the upcoming days, with the remaining funds being provided gradually, subject to two quarterly reviews. This assistance aims to help the Pakistan government implement its economic stabilization program.

The program seeks to prioritize the implementation of the FY24 budget, to facilitate “necessary fiscal adjustments” and “protect critical social spending.” It also focuses on restoring a market-determined exchange rate and seeks to equip foreign exchange markets with the capacity to handle external shocks. The IMF recommends an “appropriately tight monetary policy… to combat inflation,” and the continuation of progress of “structural reforms, particularly with regard to energy sector viability, SOE governance, and climate resilience.”

However, experts have reiterated that the current program acts merely as bridge financing, and a new IMF program will be needed immediately after this one elapses. Further, the possibility of obtaining a new program greatly hinges on the success of the current SBA. If general elections are held later this year, it is near certain that the new government will quickly find itself on the Fund’s doorstep once again.

“The country has $25 billion of debt repayments due in the fiscal year starting this month, according to Moody’s Investors Service. That’s more than five times its foreign-exchange reserves, which stood at $4.5 billion at the end of June,” reported Bloomberg.

Source: KTrade

Liquidity problem

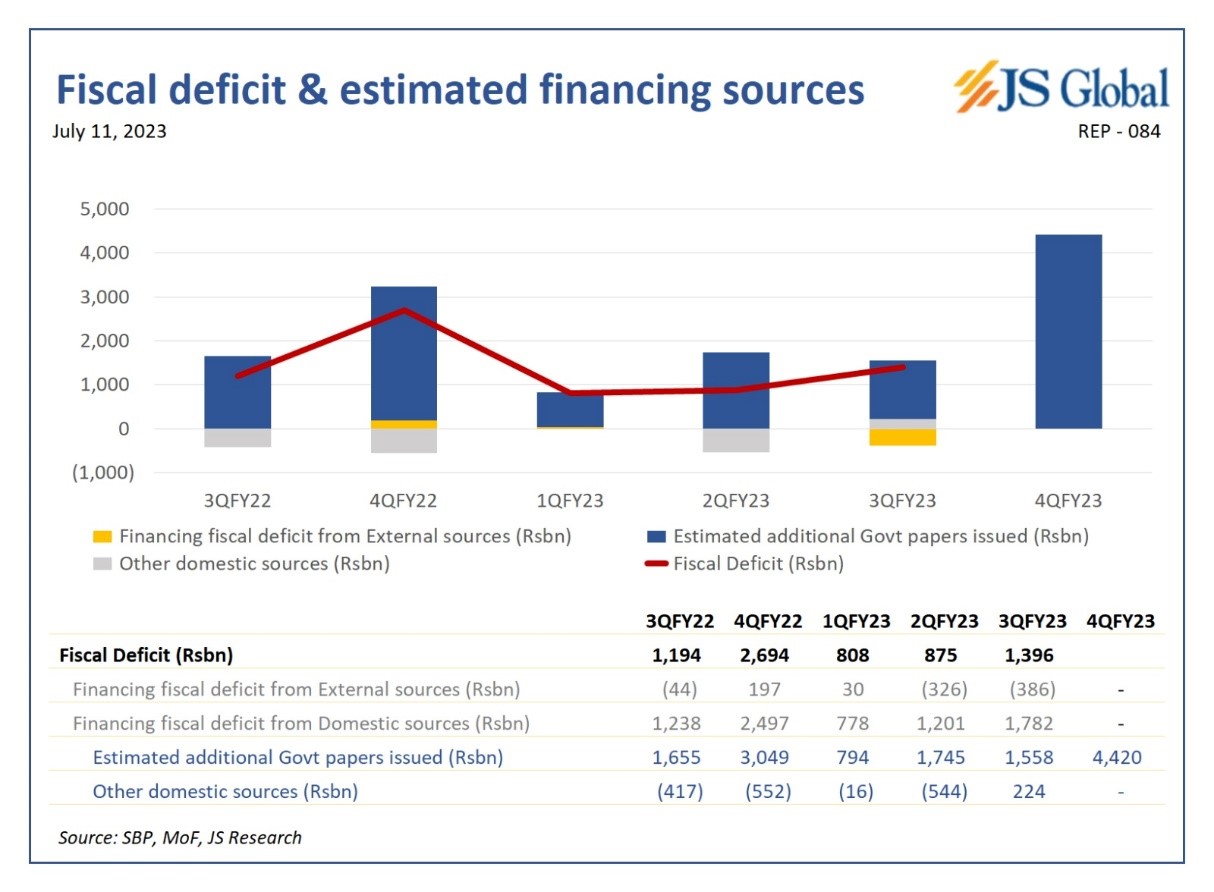

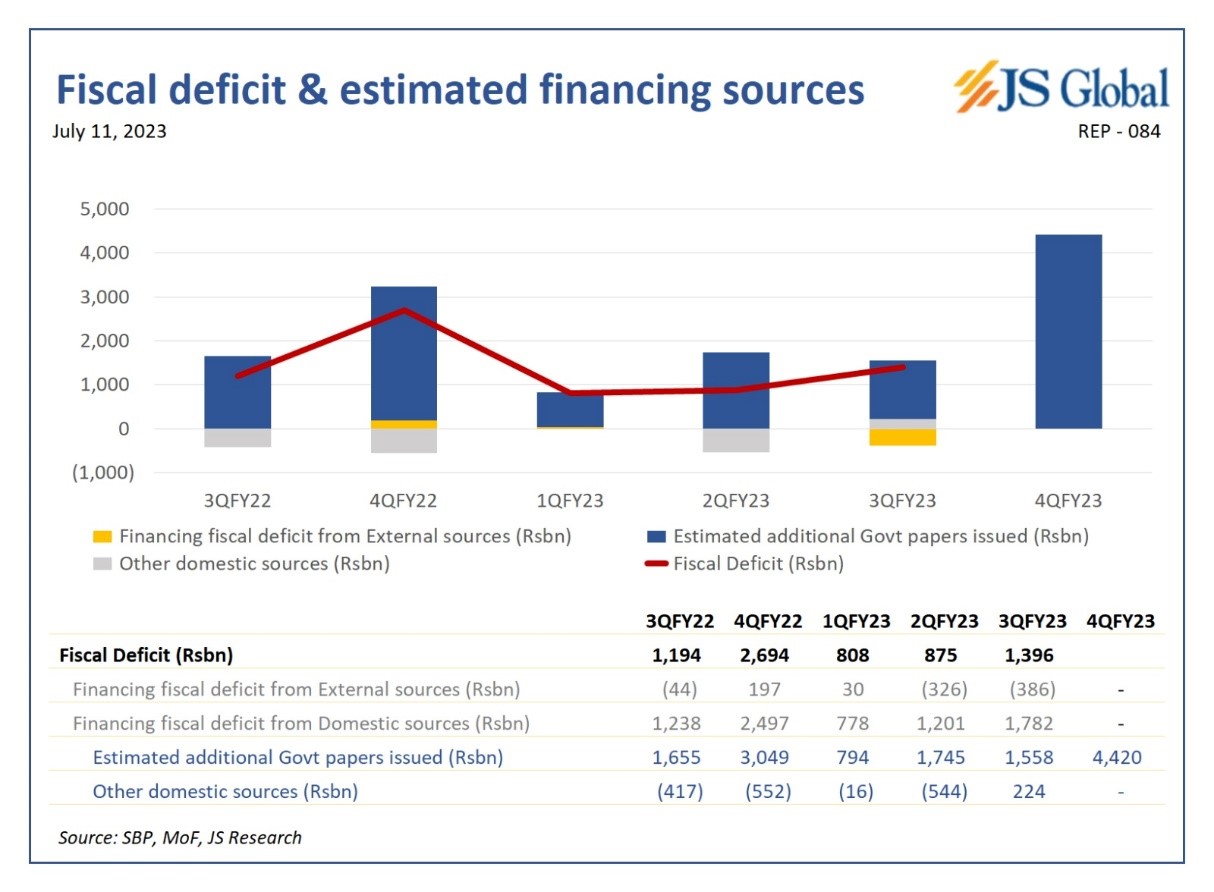

Pakistan’s economy does get a breather from the current IMF SBA, but due to poor underlying fundamentals, fiscal and liquidity troubles are likely to continue. As per a report by KTrade, The government is planning to achieve a primary surplus in FY24, as dictated by the IMF. However, the recent increase in interest rates may limit the government's ability to spend on development and subsidies due to increased debt servicing.

Inflation is expected to remain high in FY24, with the Consumer Price Index projected to be around 22-23% due to changes in energy pricing. Controlling circular debt and addressing the depreciation of the Pakistani Rupee are important goals of the IMF program, which may lead to further increases in electricity and gas tariffs.

In the short term, there is expected to be significant pressure on the external account balances. This is due to the backlog of uncleared letters of credit and delayed profit repatriations caused by recent restrictions on imports and capital flow controls. Once these restrictions are eased, there may be large outflows of capital under the trade and capital flow categories.

Further, a major strain on the country’s reserves are the massive debt repayments. “Regarding Pakistan's obligations, it is important to note that the debt to be repaid over the next twelve months is around $23 billion. Approximately 50% of this amount is expected to be rolled over. Considering the interest cost and current account deficit, the country's external financing requirement comes to around $20 billion. Continuously relying on IMF programs and taking on new debt is not a viable long-term strategy as it will require restrictive monetary and fiscal policy to keep growth and deficits in check for a prolonged period. The only way to exit this low growth scenario and stimulate the economy for job creation is an external debt rescheduling which would provide Pakistan with a 3-5 year window to implement necessary structural reforms,” stated, Mustafa Pasha, Chief Investment Officer at Lakson Investment limited.

Further, a major strain on the country’s reserves are the massive debt repayments. “Regarding Pakistan's obligations, it is important to note that the debt to be repaid over the next twelve months is around $23 billion. Approximately 50% of this amount is expected to be rolled over. Considering the interest cost and current account deficit, the country's external financing requirement comes to around $20 billion. Continuously relying on IMF programs and taking on new debt is not a viable long-term strategy as it will require restrictive monetary and fiscal policy to keep growth and deficits in check for a prolonged period. The only way to exit this low growth scenario and stimulate the economy for job creation is an external debt rescheduling which would provide Pakistan with a 3-5 year window to implement necessary structural reforms,” stated, Mustafa Pasha, Chief Investment Officer at Lakson Investment limited.

Yet, one might wonder that why Pakistan cannot achieve a significant increase in exports to address its balance of payment crisis? While focusing on exports is indeed a long-term solution, it may not lead to substantial growth in the short run. A lack of exportable surplus is considered one of the factors by Gonzalo Verela, a Senior World Bank Economist, particularly in sectors like textiles where meeting increased demand requires significant investment and expansion. The limited pool of qualified human resources in sectors like IT also poses challenges for export growth.

Focus on FDI for short term relief

Therefore, to address Pakistan's urgent need for liquidity, Foreign Direct Investment becomes the only viable option for the short-term future.

Hence, the government has approved the Pakistan Economic Policy 2023, allowing foreign investors to repatriate their entire profits in their own country's currency with special protection. The policy has removed the minimum equity rate for foreign investment, and allows foreigners to invest in most sectors, with a few exceptions. The government has expressed confidence about the potential investment from Gulf States, particularly Saudi Arabia and the UAE. These countries have shown interest in sectors such as renewable energy, information technology, agriculture, and mining.

Further, Prime Minister Shehbaz Sharif recently announced his expectation of substantial investment, amounting to billions of dollars, in Pakistan's agriculture sector over the coming years. The government plans to unlock the full potential of the sector through initiatives such as the Green Pakistan Initiative and the Special Investment Facilitation Council. During the same ceremony, the Chief of Army Staff expressed support for these efforts on behalf of the army.

The military at the forefront

Recent statements from government officials indicate a shift in focus towards the IT sector and agriculture in Pakistan. The military has also shown interest in the agriculture sector in the past, while more recently it found itself entangled in a controversy surrounding its corporate farming ambitions. While it may be natural for arguably the country's largest landowner to explore new opportunities for attracting foreign investment, there are concerns about the military's historical tendency to exert influence over the state, extract favors and drive competition out of the market thus, creating inefficiencies. Instances where the military enterprise have competed in open markets the companies have struggled.

Yet, Uzair Younus in his article for Nikkei Asia, argues that, “to many observers, the military's dominant role in the economy must be curtailed if Pakistan is to achieve sustainable growth. But well-meaning as they might be, these efforts have consistently failed to date, meaning that Military Inc. continues to be the dominant player in Pakistan's economy. It is time to accept that rather than trying to cut this empire down to size, it may be more fruitful to develop Military Inc. 2.0: a corporate empire that is globally competitive.” It remains to be seen if the military’s rising tide will lift all the country’s boats.

The program seeks to prioritize the implementation of the FY24 budget, to facilitate “necessary fiscal adjustments” and “protect critical social spending.” It also focuses on restoring a market-determined exchange rate and seeks to equip foreign exchange markets with the capacity to handle external shocks. The IMF recommends an “appropriately tight monetary policy… to combat inflation,” and the continuation of progress of “structural reforms, particularly with regard to energy sector viability, SOE governance, and climate resilience.”

However, experts have reiterated that the current program acts merely as bridge financing, and a new IMF program will be needed immediately after this one elapses. Further, the possibility of obtaining a new program greatly hinges on the success of the current SBA. If general elections are held later this year, it is near certain that the new government will quickly find itself on the Fund’s doorstep once again.

“The country has $25 billion of debt repayments due in the fiscal year starting this month, according to Moody’s Investors Service. That’s more than five times its foreign-exchange reserves, which stood at $4.5 billion at the end of June,” reported Bloomberg.

Source: KTrade

Liquidity problem

Pakistan’s economy does get a breather from the current IMF SBA, but due to poor underlying fundamentals, fiscal and liquidity troubles are likely to continue. As per a report by KTrade, The government is planning to achieve a primary surplus in FY24, as dictated by the IMF. However, the recent increase in interest rates may limit the government's ability to spend on development and subsidies due to increased debt servicing.

Inflation is expected to remain high in FY24, with the Consumer Price Index projected to be around 22-23% due to changes in energy pricing. Controlling circular debt and addressing the depreciation of the Pakistani Rupee are important goals of the IMF program, which may lead to further increases in electricity and gas tariffs.

In the short term, there is expected to be significant pressure on the external account balances. This is due to the backlog of uncleared letters of credit and delayed profit repatriations caused by recent restrictions on imports and capital flow controls. Once these restrictions are eased, there may be large outflows of capital under the trade and capital flow categories.

Further, a major strain on the country’s reserves are the massive debt repayments. “Regarding Pakistan's obligations, it is important to note that the debt to be repaid over the next twelve months is around $23 billion. Approximately 50% of this amount is expected to be rolled over. Considering the interest cost and current account deficit, the country's external financing requirement comes to around $20 billion. Continuously relying on IMF programs and taking on new debt is not a viable long-term strategy as it will require restrictive monetary and fiscal policy to keep growth and deficits in check for a prolonged period. The only way to exit this low growth scenario and stimulate the economy for job creation is an external debt rescheduling which would provide Pakistan with a 3-5 year window to implement necessary structural reforms,” stated, Mustafa Pasha, Chief Investment Officer at Lakson Investment limited.

Further, a major strain on the country’s reserves are the massive debt repayments. “Regarding Pakistan's obligations, it is important to note that the debt to be repaid over the next twelve months is around $23 billion. Approximately 50% of this amount is expected to be rolled over. Considering the interest cost and current account deficit, the country's external financing requirement comes to around $20 billion. Continuously relying on IMF programs and taking on new debt is not a viable long-term strategy as it will require restrictive monetary and fiscal policy to keep growth and deficits in check for a prolonged period. The only way to exit this low growth scenario and stimulate the economy for job creation is an external debt rescheduling which would provide Pakistan with a 3-5 year window to implement necessary structural reforms,” stated, Mustafa Pasha, Chief Investment Officer at Lakson Investment limited.Yet, one might wonder that why Pakistan cannot achieve a significant increase in exports to address its balance of payment crisis? While focusing on exports is indeed a long-term solution, it may not lead to substantial growth in the short run. A lack of exportable surplus is considered one of the factors by Gonzalo Verela, a Senior World Bank Economist, particularly in sectors like textiles where meeting increased demand requires significant investment and expansion. The limited pool of qualified human resources in sectors like IT also poses challenges for export growth.

Focus on FDI for short term relief

Therefore, to address Pakistan's urgent need for liquidity, Foreign Direct Investment becomes the only viable option for the short-term future.

Hence, the government has approved the Pakistan Economic Policy 2023, allowing foreign investors to repatriate their entire profits in their own country's currency with special protection. The policy has removed the minimum equity rate for foreign investment, and allows foreigners to invest in most sectors, with a few exceptions. The government has expressed confidence about the potential investment from Gulf States, particularly Saudi Arabia and the UAE. These countries have shown interest in sectors such as renewable energy, information technology, agriculture, and mining.

Further, Prime Minister Shehbaz Sharif recently announced his expectation of substantial investment, amounting to billions of dollars, in Pakistan's agriculture sector over the coming years. The government plans to unlock the full potential of the sector through initiatives such as the Green Pakistan Initiative and the Special Investment Facilitation Council. During the same ceremony, the Chief of Army Staff expressed support for these efforts on behalf of the army.

The military at the forefront

Recent statements from government officials indicate a shift in focus towards the IT sector and agriculture in Pakistan. The military has also shown interest in the agriculture sector in the past, while more recently it found itself entangled in a controversy surrounding its corporate farming ambitions. While it may be natural for arguably the country's largest landowner to explore new opportunities for attracting foreign investment, there are concerns about the military's historical tendency to exert influence over the state, extract favors and drive competition out of the market thus, creating inefficiencies. Instances where the military enterprise have competed in open markets the companies have struggled.

Yet, Uzair Younus in his article for Nikkei Asia, argues that, “to many observers, the military's dominant role in the economy must be curtailed if Pakistan is to achieve sustainable growth. But well-meaning as they might be, these efforts have consistently failed to date, meaning that Military Inc. continues to be the dominant player in Pakistan's economy. It is time to accept that rather than trying to cut this empire down to size, it may be more fruitful to develop Military Inc. 2.0: a corporate empire that is globally competitive.” It remains to be seen if the military’s rising tide will lift all the country’s boats.