The Ministry of Finance informed the National Assembly that more than Rs. 3.38 trillion has been collected from mobile phone users over the period of the last five years—Profit, December 12, 2024

On February 20, while speaking on the sidelines of the Munich Security Conference, IMF Managing Director Kristalina Georgieva said: “For Pakistan, I want to stress that we are emphasising two things: One, tax revenues - those who can, those making good money in the public or private sector, need to contribute to the economy. Two, to have a fairer distribution of pressures, subsidies should be extended only towards the people who really need them”—To tax or not to tax, Dr. Hamid Ateeq Sarwar, presently Member [Inland Revenue—Operations], FBR

Fiscal consolidation should be as growth-friendly as possible. In general, tax base-broadening reforms are identified as growth-oriented reforms. To the extent that they reduce distortions in economic decisions on work, saving, investment, and consumption, they should increase output and improve social welfare—Choosing a Broad Base–Low Rate Approach to Taxation, OECD Tax Policy Studies No. 19

The disclosure by the Ministry of Finance before the National Assembly of extracting trillions of rupees as advance adjustable income tax from mobile users in Pakistan during the last five years may be shocking for many. However, it has been highlighted in these columns time and again that the poorest of the poor in the Islamic (sic) Republic of Pakistan are subjected to such terrible and oppressive extraction, while a small number of rich and mighty members of the military-judicial-civil complex enjoy unprecedented tax exemptions, concessions, and waivers! The tax expenditure in the fiscal year 2023-24, as our admission of FBR, was Rs. 3.879 trillion.

The policymakers (sic) sitting in the Ministry of Finance (MoF) and top tax administrators of the Federal Board of Revenue (FBR) () have failed to inform the National Assembly that an overwhelming part of the advance tax collected from mobile/internet users is, in fact, refundable to him as the vast majority of them have either no taxable income or income below the taxable threshold. This aspect was highlighted in an article in these columns titled: A Distorted Tax Base & Extractive State. It was further elaborated in Punishing The Non-filers!

What makes the situation more painful is the fact that in this era of digitisation, rather than unlocking economic and social benefits through tax reform in the mobile sector, our extractive state is muzzling its growth through excessive taxation. This is discussed in detail in The Anatomy Of FBR’s Collections, Fixing the ailing tax system, Of taxpayers & non-filers, Fallacies about tax base , and Improving tax compliance.

Pakistan’s prevailing tax system is unjust, outmoded, and unproductive with high taxes, yielding low revenues made worse by the complex, time-consuming, and costly operational procedure for compliance.

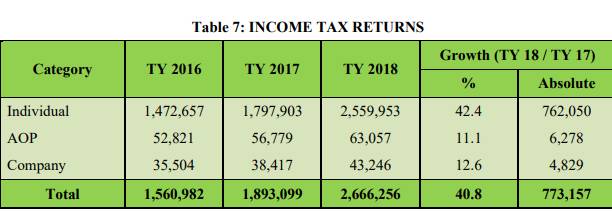

There were over 100 million unique mobile users who paid advance, adjustable income tax in fiscal year (FY) 2017-18, but return filers were pathetically low at 2,666,256 for tax year 2018, as per Table reproduced below from FBR’s Year Book 2018-19. Since then, the FBR has stopped divulging such information in any official publication. The Active Taxpayers List as of December 13, 2024, showed total individual income tax filers at 3,923,179 and others (companies and firms etc) at 1,825,946. Out of these total 5,749,125 filers, 70% have declared no income or income below taxable threshold or losses or paid insignificant tax with return.

Pakistan’s prevailing tax system is unjust, outmoded, and unproductive with high taxes, yielding low revenues made worse by the complex, time-consuming, and costly operational procedure for compliance. It is not taxing the people according to their ability to pay but relying mainly on regressive indirect taxes, as these take a much larger percentage of earnings from low-income families than from high-income earners.

It is aptly highlighted in Choosing a Broad Base–Low Rate Approach to Taxation [OECD, Tax Policy Studies No. 19 of 2010] that fiscal consolidation should be as growth-friendly as possible. The tax base-broadening strategy in Pakistan has never been perceived/discussed as “growth-oriented reform” by official quarters lenders and donors. It is highlighted in Tax Reforms in Pakistan: Historic & Critical View, PIDE Reform Agenda for Accelerated and Sustained Growth and Towards Flat, Low-rate, Broad and Predictable Taxes that tax reforms should increase output, improve social welfare and must be aimed at reducing distortions in economic decisions on work, saving, investment and consumption.

Let us try to determine a rational income tax base. According to the 2023 official population census, our population was 241,499,431, which as of today (December 13, 2024, at 1 pm) is 250,049,860. The dependent population of children under the age of 15 years is around 35% while 4% of people are above 65 years. Out of the total population, 70 million are below the poverty line earning less than two dollars a day. Our employed labour force as per the Economic Survey of Pakistan 2024 is around 72 million—the majority of it based in rural areas [48.5%] that earned below taxable income or agricultural income falling outside the ambit of Income Tax Ordinance, 2001.

Analysing all the above figures (juxtaposed), individuals liable to income tax and eligible to file returns for the tax year 2023 could not have been more than 20 million. However, 120 million unique mobile users [total subscribers as of June 30, 2023, were 191 million] paid 15% advance/adjustable income tax, though return filers remained 4.3 million (only 1.30 million showing any taxable income).

According to the Pakistan Telecommunication Authority (PTA), the total cellular/broadband subscribers as of June 30, 2024, were 193 million (79.44% mobile density), 135 million mobile broadband subscribers (55.61% mobile broadband penetration), 3 million fixed telephone subscribers (1.06 teledensity) and 138 million broadband subscribers (57.05% broadband penetration).

Despite the rapid evolution of technology and digital reform, the reliance on outdated methods for tax collection remains evident. This antiquated approach fails to align with the modern business environment, resulting in inefficiencies and inequities in revenue generation.

The latest figures available for September 30, 2024 show: total cellular/broadband subscribers are 193 million (79.40% mobile density), 139 million mobile broadband subscribers (56.96% mobile broadband penetration), 3 million fixed telephone subscribers (1.06 teledensity), and 142 million broadband subscribers (58.44% broadband penetration).

The above figures prove beyond any doubt that with effect from July 1, 2024, the entire taxable population and even those having no income or income below the taxable limit are paying advance and adjustable 15% income tax as filers, and 75% in case of those mentioned in a general order issued under section 114B of the Income Tax Ordinance, 2001, being prepaid or postpaid mobile/broadband/internet users.

It means that all adults in Pakistan having bio-metrically verified mobile connections were/are paying income tax, whether they earn taxable income or not! If all of them file returns, not less than 100 million will be entitled to refunds. However, it is also disturbing to note that till today total number of persons (natural and legal) showing any taxable income is as low as 1.8 million. It is high time that the FBR publish the data of filers which is its duty under Article 19A of the Constitution which reads: “Every citizen shall have the right to have access to information in all matters of public importance subject to regulation and reasonable restrictions imposed by law”.

The government’s approach to broadening the tax base in Pakistan reveals a critical oversight in adapting to contemporary economic realities as highlighted in IMF, Mini Budget, Taxes & Growth—II. Despite the rapid evolution of technology and digital reform, the reliance on outdated methods for tax collection remains evident. This antiquated approach fails to align with the modern business environment, resulting in inefficiencies and inequities in revenue generation.

A fundamental step toward addressing these shortcomings is the digitisation of the economy. First and foremost, establishing a clear vision and strategic plan is essential. This involves setting specific goals for digital transformation, such as increasing transparency and efficiency and outlining a roadmap with detailed timelines and required resources. Additionally, updating the regulatory framework to support digital transactions is essential.

This includes implementing standards for digital identity verification, security, and transaction processes to ensure that digital interactions are secure and legally compliant. Promoting digital literacy is another critical step. Comprehensive training programmes and public awareness campaigns are prerequisites to help businesses and individuals understand and utilise digital tools effectively. Alongside this, investing in digital infrastructure is paramount. Expanding reliable internet access and upgrading IT infrastructure, such as data centers and cybersecurity measures, will support seamless digital transactions and monitoring.

Our rulers still dream about bringing IT revolutions and claim and cherish their efforts for the promotion of information technology. The reality is that they are not ready to implement basic legislation to ensure privacy and protect the data.

In the financial sector, digitising banking services through online and mobile platforms, as well as promoting digital wallets and fintech innovations, will modernise financial transactions and improve tax tracking which Pakistani banks are offering. However, the need is to improve the ratio of financial inclusion, which is extremely low, in comparison to neighbouring China, India, and Iran. Similarly, the retail sector must adapt by integrating e-commerce platforms, digital point-of-sale systems, and digital marketing tools to streamline tax compliance. For the wholesale sector, digital B2B platforms and improved supply chain management through digital tools will enhance efficiency and transparency.

The trade sector (wholesale and retail) also requires digitisation, including the adoption of electronic trade documents and digital customs processes to facilitate smoother cross-border transactions. Addressing the role of middlemen/intermediaries by developing digital platforms for brokers and agents will reduce inefficiencies and enhance transaction transparency.

The governmental services should transition to e-government platforms, integrating data across agencies to streamline public sector operations and improve service delivery. Moreover, ensuring robust data privacy and security through strong data protection laws and advanced cybersecurity measures is essential to safeguard digital transactions and personal information. However, it is a failure on the part of our legislature that they have failed to pass the data privacy laws. It is a shocking reality that despite tall claims to digitise the FBR, until today, Pakistan has not passed even the personal data protection law.

However, our rulers still dream about bringing IT revolutions and claim and cherish their efforts for the promotion of information technology. The reality is that they are not ready to implement basic legislation to ensure privacy and protect the data.

Regular monitoring and evaluation, including audits and feedback mechanisms, can ensure the effectiveness of digital systems and prompt resolution of issues. Such steps on the part of the government will not only support innovation and adaptation but also certainly promote research and development in digital technologies, which will keep the economy competitive. For this, public-private partnerships and international cooperation will facilitate the adoption of best practices and technologies, aligning Pakistan’s economic practices with global standards. By undertaking these comprehensive steps, the government can modernise tax collection, broaden the tax base, and enhance overall economic efficiency.