For two countries with almost the same cost of living, income tax on salaried employees in Pakistan is up to 9.4 times that in India - see attached. Taxed employees in Pakistan certainly do not get better value for their contribution. Our tax system is far from equitable—Pakistan Business Council in a social media post on July 25, 2024

In line with the IMF agreement, the Federal Board of Revenue (FBR) has revised its annual tax collection target downward from Rs12,970 billion to Rs12,913 billion for the current fiscal year 2024-25—FBR revises down collection target to Rs.12,913tr after IMF nod, The News, July 28, 2024

Pakistan has one of the world’s lowest tax ratios, stemming from five main weaknesses: complexity, a narrow tax base, low compliance, inefficient tax administration, and low and declining provincial tax revenues. Complexity provides scope for discretion and corruption. A narrow tax base and low compliance are the outcomes of inequitable exemptions and preferential treatments, low tax registration or filing, and massive tax evasion by potential taxpayers that prefer to stay informal. Provincial taxation is low and declining. For its part, nontax revenue is also declining—Pakistan Policy Note 16: Mobilizing Revenue, Jose R. Lopez-Calix and Irum Touqeer, The World Bank

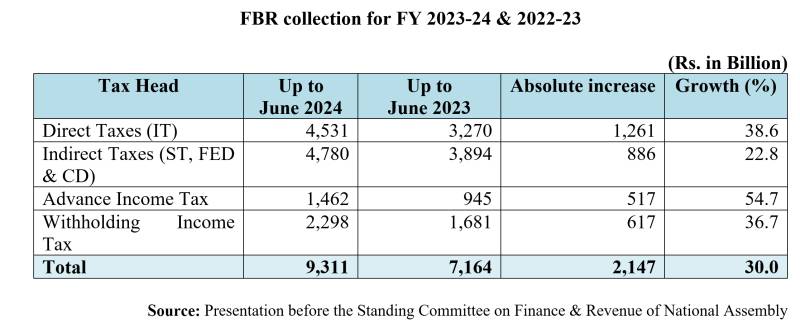

The Federal Board of Revenue (FBR) has surpassed the revised target of Rs. 9252 billion for fiscal year (FY) 2023-24 and for the first time crossed the mark of Rs. 9 trillion by collecting Rs. 9,311 billion (still provisional subject to final reconciliation with Auditor General of Pakistan). It is commendable but well short of the original target of Rs. 9,415 billion set at the time of the budget. It is not something new—except for the FY 2021-22 when FBR achieved a rare feat by meeting the originally-assigned targets. It is an undeniable fact that FBR has a unique record of even missing many times revised targets in many years resulting in more than anticipated fiscal gap by the budget makers.

It is worthwhile to mention that FBR never reveals accumulative figure of determined refunds not issued (deliberately blocked is a better connotation) during a fiscal year. In other words, to that extent, collection is overstated—this aspect is highlighted repeatedly in these columns but till date, no independent audit is conducted to this effect by the Auditor General of Pakistan, even though it is a constitutional responsibility that was reminded to him in the column published on July 6, 2024.

There exists a national consensus about huge tax gap in Pakistan partly because of weaknesses in enforcement and partly due to bad tax policy. On July 22, 2023, FBR’s website showed a total of 5,056,639 persons on Active Taxpayers List (ATL)—updated every Monday. It may be noted that December 31, 2023 was the last date for filing returns for all categories of taxpayers in Pakistan. The data available on ATL show individuals return filers at 3,392,309 and 1,664,330 returns filed by companies, firms and association of persons (AOPs) combined.

Heavy taxation on electricity bills and a number of food items and those of daily use by the citizens is completely unjustified when tax expenditure remains as high as four trillion in FY 2023-24 if calculated by including hidden tax benefits to militro-judicial-civil complex.

Unfortunately, till the time of writing these lines, FBR did not convey (though requested), the total returns filed for tax year 2023, tax paid with returns and refund claimed. Hopefully, these statistics will be made public by FBR soon—to acquire such information is the fundamental right of every citizen under Article 19A of the Constitution.

The real performance of FBR in direct taxes should be judged on the basis of new taxpayers added and recovery out of current and arrear demands. It appears from figures quoted before the National Assembly’s Standing Committee on Finance & Revenue on July 12, 2024 for the FY 2023-24 that overwhelming portion of income tax collection, Rs. 4.5 trillion, is still being channeled to the state’s coffers through withholding provisions and advance tax, Rs. 3.8 trillion, plus admitted liability paid with return voluntarily. The collection with efforts by FBR field formations out of current and arrears remain much below the mark of even 10 percent of total income tax collection. The figures related to income tax collection in the following table testifies to this fact.

No doubt that the FBR collects the bulk of income tax through pass on withholding taxes, which in essence is indirect taxation or taxes at the time of clearing of goods and advance tax pertaining to the next fiscal year. The disproportional and cruel taxation of salaried persons in the formal sector is the worst legacy of the apex revenue authority as highlighted by this scribe in a recent article.

This important institution suffers from multiple shortcomings, like basic logistics, lack of modern tools, no center of excellence for fiscal research and administration, trained staff to enforce the various anti-avoidance provisions in all the tax laws it administers—Income Tax Ordinance, 2001, Sales Tax Act, 1990, Customs Act, 1969 and Federal Excise Act, 2015.

The State must collect taxes where due and not in advance or from those not chargeable to tax. Provision like section 236 and many others providing withholding of taxes on transactions rather than real incomes reflect a bad tax policy—anti-poor and contradictory to FBR’s claim of increasing direct taxes by diligently taxing the rich and the mighty.

According to a news report: “Tax collection from contractors and service providers jumped by 27% to Rs 498 billion in the last fiscal year–the highest contribution to withholding taxes. This also includes contributions by salaried individuals who provide services under certain contracts”. The report further revealed that “collection on profit on debt jumped 52% to Rs 488 billion,” a direct impact of higher interest rates. “Importers paid Rs 381 billion in income tax on various types of imports – the third-largest contributor to withholding taxes,” it added.

The real potential of taxable income tax payers and sales tax was highlighted earlier in these pages. At present, the entire taxable population and even those having no income or income below taxable limit are paying advance and adjustable income tax at source as mobile users, yet FBR, lenders, donors, and the media unashamedly call the people of Pakistan tax cheats. This is highly lamentable. Had this been the case, how did FBR collect so much tax at source (58% of total income tax collection in FY 2023-34)!

The State must collect taxes where due and not in advance or from those not chargeable to tax. Provision like section 236 and many others providing withholding of taxes on transactions rather than real incomes reflect a bad tax policy—anti-poor and contradictory to FBR’s claim of increasing direct taxes by diligently taxing the rich and the mighty.

The coalition government of Pakistan Tehreek-i-Insaf (PTI) resorted to oppressive taxation during its rule and its successors, the alliance government of Pakistan Democratic Movement (PDM) and presently its second coming, are doing even worse. It is high time that the state stop taxing the less-privileged and downtrodden. Why are the poor still subjected to oppressive taxes like 15% advance income on mobile and internet use from July 1, 2022? The rich and mighty are yet enjoying tax-free perquisites and benefits of billions of rupees.

Heavy taxation on electricity bills and a number of food items and those of daily use by the citizens is completely unjustified when tax expenditure remains as high as four trillion in FY 2023-24 if calculated by including hidden tax benefits to militro-judicial-civil complex.

Tax credits for senior citizens and special people that were available before the enhancement of tax rates by Finance Act, 2019 should have been restored by the incumbent government in 2024 budget, but it failed to do so.

The fixed and turnover on traders are ill-advised. Many years back, on a query about such unfair taxation, Dr. Ehtisham Ahmad, renowned economist, with a rich experience in restructuring tax systems of various countries commented: “It may also create incentives for larger firms to masquerade as SMEs, or hide value chains by transacting with untraceable SMEs. Much depends on how the GST/VAT is applied. The Mexicans solved the problem by effectively dropping the VAT registration threshold to zero, bringing in complete value chains without the possibility of manipulation by the SMEs or the larger firms using the SMEs (important in textiles for example).”

Tax credits for senior citizens and special people that were available before the enhancement of tax rates by Finance Act, 2019 should have been restored by the incumbent government in 2024 budget, but it failed to do so.

On proposal of harmonized sales tax on goods and services, single national tax agency and National Tax Court. Dr. Ehtisham Ahmad responded: “I strongly support the three issues mentioned, but would add that it is useful to consider a different administration model to that recommended by the IMF which focuses on primarily on large taxpayers. Integrating SMEs into the regular tax regime is critical—also for their uplift, including electronic invoicing and greater efficiency and integration with global value chains. Also, the more accurate and timely information would help to block leakages in the income tax, including by large taxpayers who hide productions, employment and profits by transacting with invisible smaller taxpayers/suppliers—so whole chains disappear (as in textiles). It is a mistake to keep beating up on middle income wage earners…. This is regressive at best, since non-wage income remains notoriously difficult to tax. You also need an arms’ length administration with information-based audits. And impartial tax courts as you propose.”

Prime Minister Shehbaz Sharif must take personal interest in the above recommendations and also order the FBR to pay refunds of adjustable tax collected in advance from millions of mobile users having no or non-taxable income during the last 10 years. Tax refunds to the needy will be a great gesture on the State’s part in helping all those earning no income or income below taxable limit in these very difficult days when oppressive taxation, imposed through the Finance Act, 2024, can force millions more to be pushed in the below poverty line category.