Recently, Pakistan paid off a $1 billion Chinese loan, only to have it refinanced days later. Additionally, the nation plans to repay another $300 million next week, which is also expected to be refinanced, while China is expected to roll over another $1 billion by June 30. This follows $2 billion in support received from Chinese banks in March of this year.

This Chinese support comes as Pakistan has been grappling with a severe economic crisis. Despite facing difficulties making progress with the International Monetary Fund, the country has received a much-needed boost from friendly countries like China. On the other hand, countries such as the UAE have demanded due payment on commercial loans.

The question still remains as to how long China can continue to provide support to its western neighbor.

Pakistan’s debt profile & China’s support

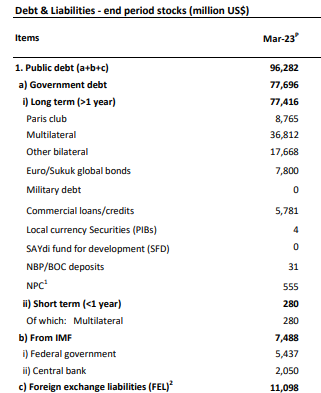

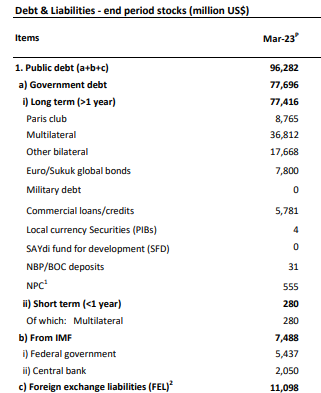

Pakistan has total public debt of approximately $96 billion. Of this amount, $37 billion is owed to multilateral organizations, including the World Bank Group; $7.5 billion is owed to the International Monetary Fund (IMF); $8.8 billion is to be paid to the Paris Club; $7.8 billion is due for Eurobonds and Sukuk; $5.8 billion is to be paid to commercial creditors; and finally, $17.7 billion is to be paid to other bilateral lenders. Additionally, the state owes $11 billion in foreign exchange liabilities. Out of this more than one quarter of the amount is owed to China.

Source: SBP

Over the past 15 years, China has increasingly provided support to developing countries, including Pakistan. The country has invested heavily in safeguarding its Belt and Road Infrastructure (BRI) projects and has spent $240 billion between 2008 and 2021 on bailing out 22 developing countries, according to a paper on China's role in global finance. Among the top recipients were Argentina, Pakistan, and Egypt, with $111.8 billion, $48.5 billion, and $15.6 billion in bailouts respectively.

“In the past, Beijing has tended to lend more money to some countries, including Argentina, Ecuador and Pakistan, so that they can continue to make payments on existing loans. China’s approach helps these countries afford imports of food and fuel, but leaves them with ever more debt,” reads an article in The New York Times.

Additionally, being home to China's flagship project under the Belt and Road Initiative, CPEC, Pakistan’s importance has elevated for China.

The Noise of Default

While China helps to keep the country afloat, the concerns of default have risen specially after the recent budget.

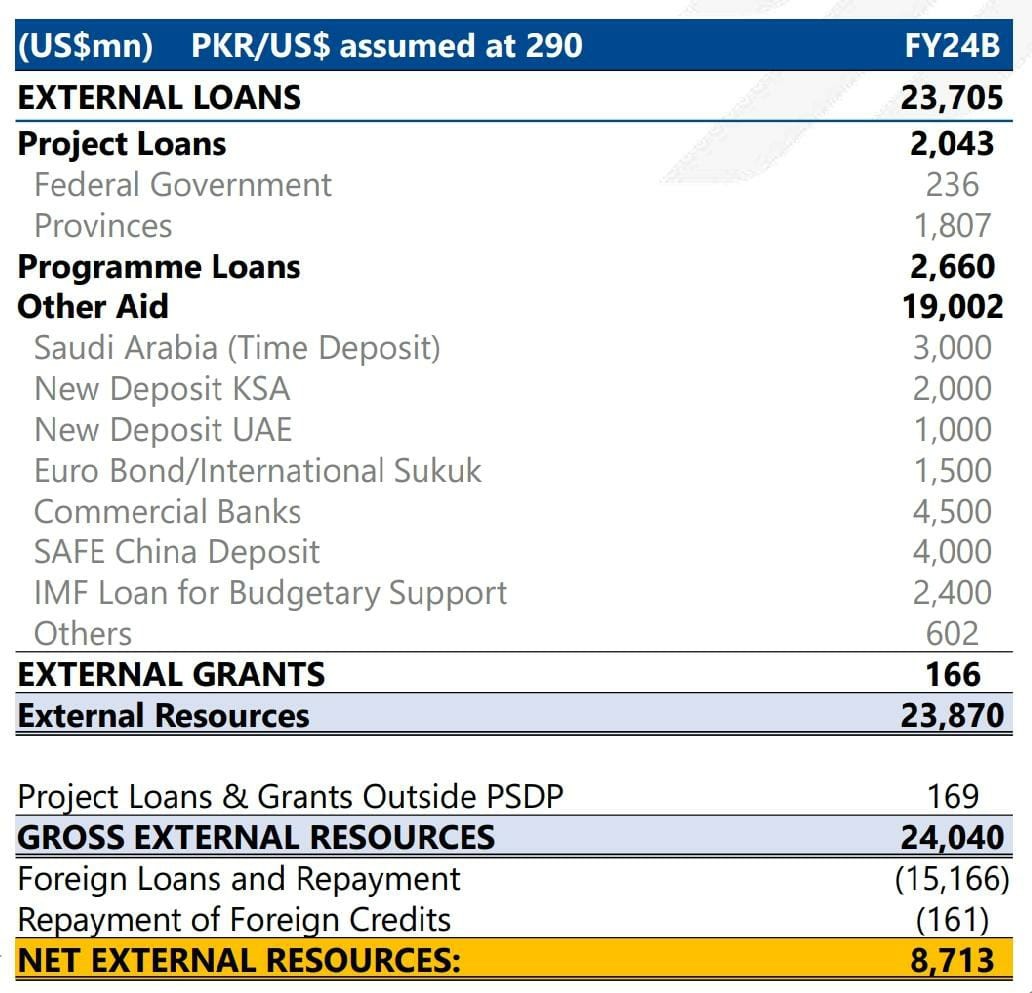

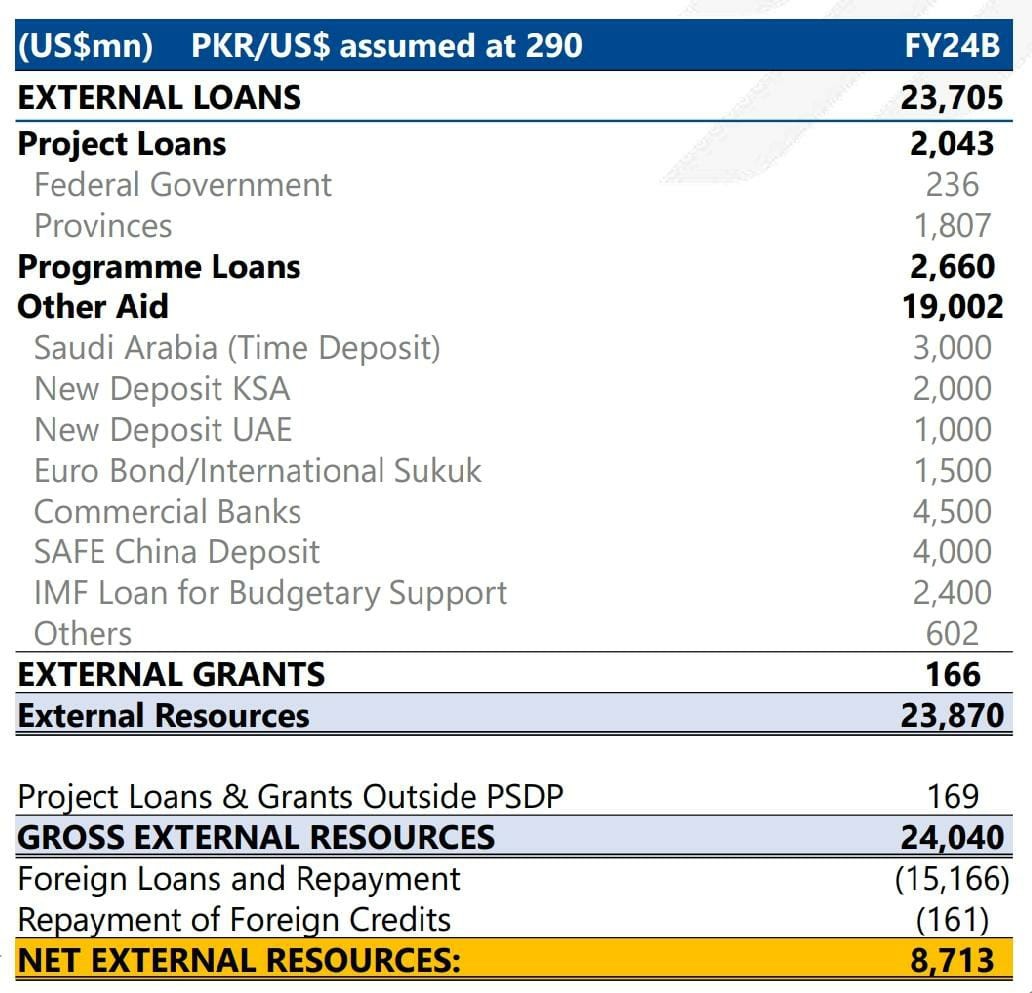

Business & Economy Journalist, Khurram Husain, in his article for Dawn explains that in FY24, Pakistan is expected to face challenges in the external sector, which could affect the exchange rate, inflation, and energy supply chain. He states that the government's external financing plan for the year sounds optimistic in the absence of an IMF program. Further, Finance Minister Ishaq Dar's talk of possible debt restructuring could complicate efforts to secure critical rollovers in June and July. Husain argued that if financing support does not arrive quickly, the country risks a precarious situation that could have serious consequences for its economy.

Amreen Soorani, Head of Research at JS Global Capital, stated, “the budget accounts for almost $10 billion from friendly countries and $4.5 billion from commercial banks. Last year, commercial bank financing was unusually low, at around $900 million, which suggests that commercial banks might not be involved in funding in FY24 unless an IMF deal is signed.”

She also mentioned, “the country has been refinancing and rolling over its scheduled payments and does not have enough dollars to pay creditors or multinationals looking to repatriate profits. However, the probability of default, according to the definition, is low.”

Source: JS Capital

Economist Shahid Mahmood presents an alternate view on the matter, stating that political, foreign policy, and geopolitical factors should be considered. He suggests that challenges at the external front have subsided, citing a normalization in resentment from friendly countries and rising commodity prices. Additionally, he notes that Pakistan is moving towards de-dollarization and there are indications of the country entering barter agreements with Iran, Afghanistan, and China. Mahmood also points out that external conditions, such as China's internal debt problem, could make it easier for Pakistan to receive loans from Chinese commercial banks. Moreover, Pakistan's inflows have not decreased, and the government can limit outflows by taking measures to decrease the current account deficit. While default is still a possibility, Mahmood suggests that the Pakistani economy may continue to face low GDP growth if the current situation persists.

Back to China?

As per a report by Topline Securities, “There is an urgent need for Pakistan to engage with China and capitalize on its historical ties to get this less painful orderly debt reprofiling at reasonable terms and conditions. It has been reported that China seems unwilling to participate in debt restructuring unless other lenders including World Bank and other regional development banks also agree to write down their own loans.”

Source: Topline Securities

The report also added that the process of debt restructuring in Pakistan is an urgent issue, with the current coalition government's term ending in August 2023. The incoming interim and subsequent newly elected governments may not have the capacity to initiate the process immediately. There's a slight chance the present government might extend its term by invoking Article 232 of the Constitution citing 'Emergency'. Delay in debt restructuring increases the risk of a default with severe consequences.

However, relying heavily on Chinese support to carry the economy could leave Pakistan in a precarious position. Hussain Haqqani, in his article for Foreign Affairs Magazine, argues that Pakistan is currently relying on its strategic significance to both China and the world in the hope that it may avoid an economic collapse like Sri Lanka's. However, he warns that Pakistan's unhealthy dependence on China and political instability could lead to a challenging situation where the military becomes entangled. The country's previous Western allies are now less involved in part due to Pakistan's support for jihadist groups and the Afghan Taliban. To avoid political and economic chaos, Pakistan must implement long overdue reforms, limit government spending, distance themselves from terrorist groups and explore trade with India. These measures would help attract foreign investments and ease financial commitments. It is crucial for Pakistan to become self-sufficient rather than continuing to rely on China. The United States could help accomplish this by refraining from outbidding China's investments in Pakistan, and rethinking its policy towards the country.

This Chinese support comes as Pakistan has been grappling with a severe economic crisis. Despite facing difficulties making progress with the International Monetary Fund, the country has received a much-needed boost from friendly countries like China. On the other hand, countries such as the UAE have demanded due payment on commercial loans.

The question still remains as to how long China can continue to provide support to its western neighbor.

Pakistan’s debt profile & China’s support

Pakistan has total public debt of approximately $96 billion. Of this amount, $37 billion is owed to multilateral organizations, including the World Bank Group; $7.5 billion is owed to the International Monetary Fund (IMF); $8.8 billion is to be paid to the Paris Club; $7.8 billion is due for Eurobonds and Sukuk; $5.8 billion is to be paid to commercial creditors; and finally, $17.7 billion is to be paid to other bilateral lenders. Additionally, the state owes $11 billion in foreign exchange liabilities. Out of this more than one quarter of the amount is owed to China.

Source: SBP

Over the past 15 years, China has increasingly provided support to developing countries, including Pakistan. The country has invested heavily in safeguarding its Belt and Road Infrastructure (BRI) projects and has spent $240 billion between 2008 and 2021 on bailing out 22 developing countries, according to a paper on China's role in global finance. Among the top recipients were Argentina, Pakistan, and Egypt, with $111.8 billion, $48.5 billion, and $15.6 billion in bailouts respectively.

“In the past, Beijing has tended to lend more money to some countries, including Argentina, Ecuador and Pakistan, so that they can continue to make payments on existing loans. China’s approach helps these countries afford imports of food and fuel, but leaves them with ever more debt,” reads an article in The New York Times.

Additionally, being home to China's flagship project under the Belt and Road Initiative, CPEC, Pakistan’s importance has elevated for China.

The Noise of Default

While China helps to keep the country afloat, the concerns of default have risen specially after the recent budget.

Business & Economy Journalist, Khurram Husain, in his article for Dawn explains that in FY24, Pakistan is expected to face challenges in the external sector, which could affect the exchange rate, inflation, and energy supply chain. He states that the government's external financing plan for the year sounds optimistic in the absence of an IMF program. Further, Finance Minister Ishaq Dar's talk of possible debt restructuring could complicate efforts to secure critical rollovers in June and July. Husain argued that if financing support does not arrive quickly, the country risks a precarious situation that could have serious consequences for its economy.

Amreen Soorani, Head of Research at JS Global Capital, stated, “the budget accounts for almost $10 billion from friendly countries and $4.5 billion from commercial banks. Last year, commercial bank financing was unusually low, at around $900 million, which suggests that commercial banks might not be involved in funding in FY24 unless an IMF deal is signed.”

She also mentioned, “the country has been refinancing and rolling over its scheduled payments and does not have enough dollars to pay creditors or multinationals looking to repatriate profits. However, the probability of default, according to the definition, is low.”

Source: JS Capital

Economist Shahid Mahmood presents an alternate view on the matter, stating that political, foreign policy, and geopolitical factors should be considered. He suggests that challenges at the external front have subsided, citing a normalization in resentment from friendly countries and rising commodity prices. Additionally, he notes that Pakistan is moving towards de-dollarization and there are indications of the country entering barter agreements with Iran, Afghanistan, and China. Mahmood also points out that external conditions, such as China's internal debt problem, could make it easier for Pakistan to receive loans from Chinese commercial banks. Moreover, Pakistan's inflows have not decreased, and the government can limit outflows by taking measures to decrease the current account deficit. While default is still a possibility, Mahmood suggests that the Pakistani economy may continue to face low GDP growth if the current situation persists.

Back to China?

As per a report by Topline Securities, “There is an urgent need for Pakistan to engage with China and capitalize on its historical ties to get this less painful orderly debt reprofiling at reasonable terms and conditions. It has been reported that China seems unwilling to participate in debt restructuring unless other lenders including World Bank and other regional development banks also agree to write down their own loans.”

Source: Topline Securities

The report also added that the process of debt restructuring in Pakistan is an urgent issue, with the current coalition government's term ending in August 2023. The incoming interim and subsequent newly elected governments may not have the capacity to initiate the process immediately. There's a slight chance the present government might extend its term by invoking Article 232 of the Constitution citing 'Emergency'. Delay in debt restructuring increases the risk of a default with severe consequences.

However, relying heavily on Chinese support to carry the economy could leave Pakistan in a precarious position. Hussain Haqqani, in his article for Foreign Affairs Magazine, argues that Pakistan is currently relying on its strategic significance to both China and the world in the hope that it may avoid an economic collapse like Sri Lanka's. However, he warns that Pakistan's unhealthy dependence on China and political instability could lead to a challenging situation where the military becomes entangled. The country's previous Western allies are now less involved in part due to Pakistan's support for jihadist groups and the Afghan Taliban. To avoid political and economic chaos, Pakistan must implement long overdue reforms, limit government spending, distance themselves from terrorist groups and explore trade with India. These measures would help attract foreign investments and ease financial commitments. It is crucial for Pakistan to become self-sufficient rather than continuing to rely on China. The United States could help accomplish this by refraining from outbidding China's investments in Pakistan, and rethinking its policy towards the country.