Over the past few days, the economic front has regained the spotlight from the political drama, due to events like the budget and SBP's monetary policy committee (MPC) meeting. These developments have attracted significant attention and interest.

The front pages of news outlets throughout the country are brimming with comments on the budget. However, what has arguably garnered the most attention are the remarks made by Finance Minister Ishaq Dar regarding restructuring bilateral debt. It appears that the finance minister has abandoned hope for the current IMF program revival and is seeking debt relief from key bilateral partners, most notably China.

Opinions are divided among experts regarding this matter, particularly in regards to the feasibility of restructuring debt without the help of the IMF. Additionally, the issue of domestic debt, which is the primary burden on the country's fiscal account, remains unaddressed.

Dealing with external debt

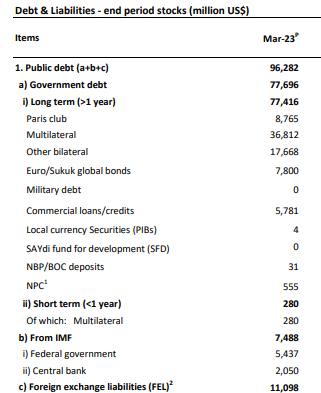

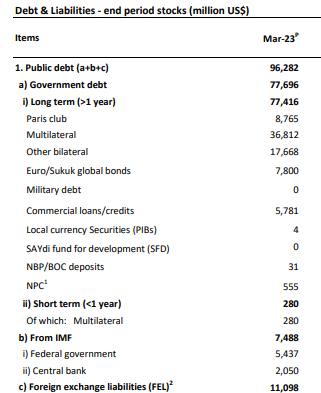

Pakistan has a total public debt of approximately $96 billion. Of this amount, $37 billion is owed to multilateral organizations, including the World Bank Group; $7.5 billion is owed to the International Monetary Fund (IMF); $8.8 billion is to be paid to the Paris Club; $7.8 billion is due for Eurobonds and Sukuk; $5.8 billion is to be paid to commercial creditors; and finally, $17.7 billion is to be paid to other bilateral lenders. Additionally, the state owes $11 billion in foreign exchange liabilities.

Source: SBP

The burden of debt repayment presents a considerable challenge for Pakistan in the medium term. Specifically, the nation must repay a staggering $77.5 billion between April 2023 and June 2026, which represents 22% of the country's GDP. This significant sum will primarily be directed towards Chinese financial institutions, private creditors, and Saudi Arabia over the next three years.

Dar is specifically targeting Chinese and Middle Eastern lenders to reprofile and extend their maturities, as China is unlikely to consider a request for a debt haircut. The finance minister has already conducted a meeting with the Chinese envoy, updating her on the budget, IMF program, and the prevailing economic situation

“The negotiations of reprofiling are with China and the Middle Eastern countries. In terms of repayment, around $10 billion is short term to be paid in FY24 and assumed to re-roll every year (already these are being rerolled this year). This $10 billion needs to be converted into the long term. And in addition, another $5-10 billion in long-term loans (or investment) is required to deal with $20 billion public debt repayment next year. And once that is to be dealt with, the repayment to be reduced by $10 billion each in the subsequent two years, and the repayment to reduce to a level to end the panic. Then with softening global commodity prices, the country can steer out of the crisis,” writes, business and economy journalist, Ali Khizar, in his article for the Business Recorder.

What’s stopping him?

Numerous factors obstruct the process of debt restructuring, with one of the main issues being a lack of coordination and consensus among the involved parties.

“The SBP is not aware of any discussion regarding debt restructuring. At this stage, there is absolutely no plan for any debt restructuring whether domestic or foreign. The SBP remains optimistic that the 9th review will be completed, and the tranche will be received,” read a briefing statement by IISL of the latest MPC meeting.

The statement above does not instill much confidence, suggesting that either Dar has provided false hope to the public or deliberately excluded the State Bank of Pakistan from pertinent information.

Moreover, without an agreement with the IMF, it would be challenging to persuade lenders to engage in debt restructuring.

Dr. Ahmed Jamal Pirzada, Chairman of the Independent Economic Advisory Group, remarked, "At this point, we lack adequate information regarding the nature of the discussions to which the finance minister alludes, as well as the degree of seriousness with which we should view his comments. Although it is feasible to conduct separate debt restructuring talks with China, I am skeptical about China's willingness to cooperate substantially unless we include other creditors in the negotiations. This, however, can only transpire under the IMF umbrella."

Finally, there is the issue of domestic debt. Servicing domestic debt is the largest expense on the fiscal side. As a result, without addressing this problem, achieving progress on the external front would be challenging.

Government’s domestic debt

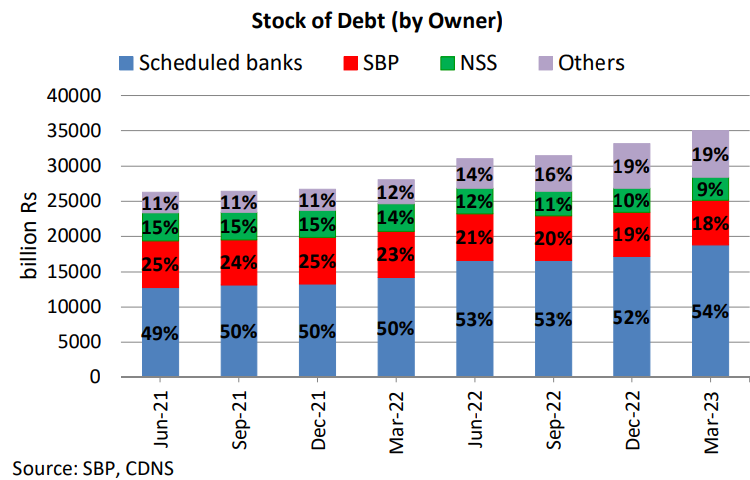

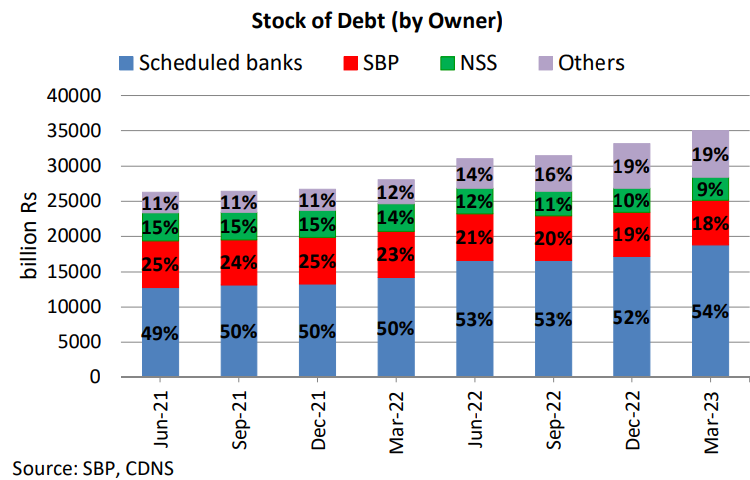

“Any idea of restructuring only bilateral debt is dead on arrival when interest payment on domestic debts are 6x those on external debts,” tweeted Jawad Hassan, a renowned columnist and former investment banker.

However, some experts believe that the fiscal impact of domestic debt servicing is overstated. They argue that those advocating for a restructuring do not consider the fact that the majority of the domestic debt comes from the State Bank of Pakistan (SBP), with commercial banks merely acting as intermediaries and charging a small margin. Consequently, the interest payments on this debt will ultimately return to the national treasury when the SBP distributes its profits to the Government of Pakistan.

The SBP already anticipates transferring more than PKR 1 trillion to the government in the form of profits at the end of current fiscal year.

https://twitter.com/MP4FMPK/status/1667516450540584964

Dar, soon to become the outgoing finance minister, is gearing up to transfer his portfolio to the caretaker setup. The pledge to restructure seemingly serves as a last-ditch attempt to restore his credibility. Nevertheless, should he fail to deliver on this promise, it would not only add to the litany of misfortunes during his brief term but also put the nation in an extremely precarious position.

The front pages of news outlets throughout the country are brimming with comments on the budget. However, what has arguably garnered the most attention are the remarks made by Finance Minister Ishaq Dar regarding restructuring bilateral debt. It appears that the finance minister has abandoned hope for the current IMF program revival and is seeking debt relief from key bilateral partners, most notably China.

Opinions are divided among experts regarding this matter, particularly in regards to the feasibility of restructuring debt without the help of the IMF. Additionally, the issue of domestic debt, which is the primary burden on the country's fiscal account, remains unaddressed.

Dealing with external debt

Pakistan has a total public debt of approximately $96 billion. Of this amount, $37 billion is owed to multilateral organizations, including the World Bank Group; $7.5 billion is owed to the International Monetary Fund (IMF); $8.8 billion is to be paid to the Paris Club; $7.8 billion is due for Eurobonds and Sukuk; $5.8 billion is to be paid to commercial creditors; and finally, $17.7 billion is to be paid to other bilateral lenders. Additionally, the state owes $11 billion in foreign exchange liabilities.

Source: SBP

The burden of debt repayment presents a considerable challenge for Pakistan in the medium term. Specifically, the nation must repay a staggering $77.5 billion between April 2023 and June 2026, which represents 22% of the country's GDP. This significant sum will primarily be directed towards Chinese financial institutions, private creditors, and Saudi Arabia over the next three years.

Dar is specifically targeting Chinese and Middle Eastern lenders to reprofile and extend their maturities, as China is unlikely to consider a request for a debt haircut. The finance minister has already conducted a meeting with the Chinese envoy, updating her on the budget, IMF program, and the prevailing economic situation

“The negotiations of reprofiling are with China and the Middle Eastern countries. In terms of repayment, around $10 billion is short term to be paid in FY24 and assumed to re-roll every year (already these are being rerolled this year). This $10 billion needs to be converted into the long term. And in addition, another $5-10 billion in long-term loans (or investment) is required to deal with $20 billion public debt repayment next year. And once that is to be dealt with, the repayment to be reduced by $10 billion each in the subsequent two years, and the repayment to reduce to a level to end the panic. Then with softening global commodity prices, the country can steer out of the crisis,” writes, business and economy journalist, Ali Khizar, in his article for the Business Recorder.

What’s stopping him?

Numerous factors obstruct the process of debt restructuring, with one of the main issues being a lack of coordination and consensus among the involved parties.

“The SBP is not aware of any discussion regarding debt restructuring. At this stage, there is absolutely no plan for any debt restructuring whether domestic or foreign. The SBP remains optimistic that the 9th review will be completed, and the tranche will be received,” read a briefing statement by IISL of the latest MPC meeting.

The statement above does not instill much confidence, suggesting that either Dar has provided false hope to the public or deliberately excluded the State Bank of Pakistan from pertinent information.

Moreover, without an agreement with the IMF, it would be challenging to persuade lenders to engage in debt restructuring.

Dr. Ahmed Jamal Pirzada, Chairman of the Independent Economic Advisory Group, remarked, "At this point, we lack adequate information regarding the nature of the discussions to which the finance minister alludes, as well as the degree of seriousness with which we should view his comments. Although it is feasible to conduct separate debt restructuring talks with China, I am skeptical about China's willingness to cooperate substantially unless we include other creditors in the negotiations. This, however, can only transpire under the IMF umbrella."

Finally, there is the issue of domestic debt. Servicing domestic debt is the largest expense on the fiscal side. As a result, without addressing this problem, achieving progress on the external front would be challenging.

Government’s domestic debt

“Any idea of restructuring only bilateral debt is dead on arrival when interest payment on domestic debts are 6x those on external debts,” tweeted Jawad Hassan, a renowned columnist and former investment banker.

However, some experts believe that the fiscal impact of domestic debt servicing is overstated. They argue that those advocating for a restructuring do not consider the fact that the majority of the domestic debt comes from the State Bank of Pakistan (SBP), with commercial banks merely acting as intermediaries and charging a small margin. Consequently, the interest payments on this debt will ultimately return to the national treasury when the SBP distributes its profits to the Government of Pakistan.

The SBP already anticipates transferring more than PKR 1 trillion to the government in the form of profits at the end of current fiscal year.

https://twitter.com/MP4FMPK/status/1667516450540584964

Dar, soon to become the outgoing finance minister, is gearing up to transfer his portfolio to the caretaker setup. The pledge to restructure seemingly serves as a last-ditch attempt to restore his credibility. Nevertheless, should he fail to deliver on this promise, it would not only add to the litany of misfortunes during his brief term but also put the nation in an extremely precarious position.